Lackluster and directionless. This can be the most appropriate description of the first session of the expiry week. The markets opened resiliently, traded in a capped range, and ended the day with a modest loss. The global setup was relatively weaker, but NIFTY saw a very resilient start to the day. It opened on a negative note but was much stronger as compared to the prevailing SGX NIFTY quote. Gradually, the markets crawled inside the positive territory in the late morning trade. The NIFTY remained absolutely quiet and subdued and stayed in a limited range while slipping again in the negative territory. The headline index ended with a modest loss of 31.60 points (-0.20%).

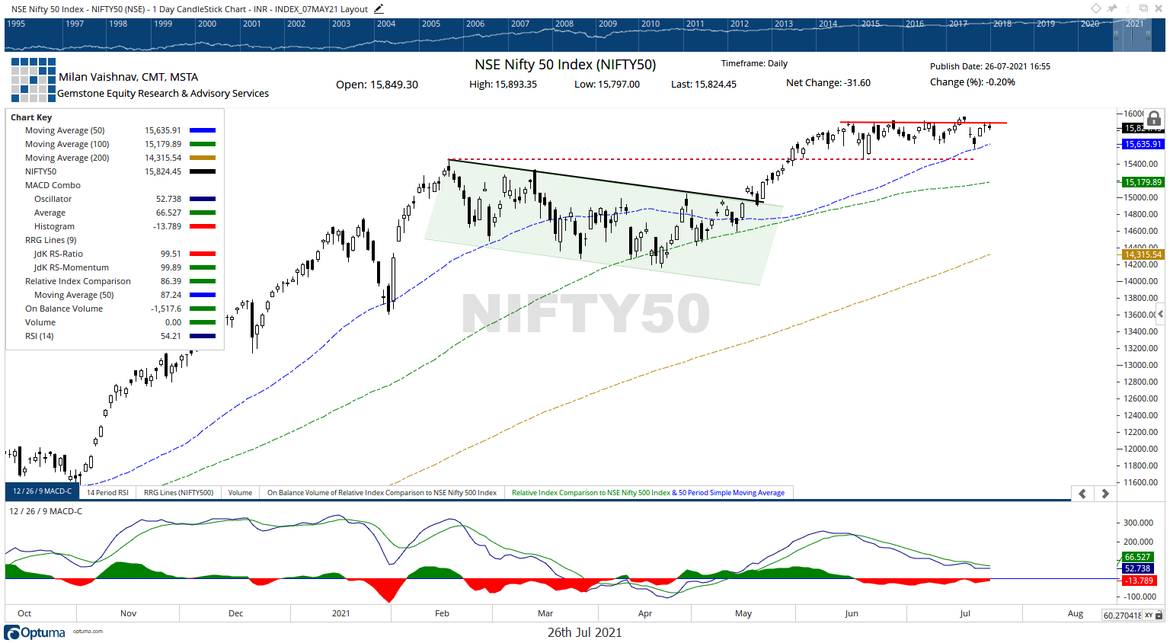

A look at the chart shows that the NIFTY is showing resilience to any kind of corrective activity. However, while it consolidates, it has continued to show great resistance to the 15900-15960 zone. Also, the amount of call writing that took place at 15800 and 15900 levels, is piling up Call OI at these strikes; 16000, however, continues to hold maximum Call Open Interest as of today. The market breadth remained negative as 30 stocks out of 50 in the NIFTY declined. Volatility rose as INDIAVIX spiked by 5.84% to 12.4500.

Tuesday is likely to see the levels of 15950 and 15985 acting as resistance points. The supports come in at 15780 and 15700 levels.

The Relative Strength Index (RSI) stands at 54.21; it stays neutral and does not show any divergence against the price. The daily MACD is bearish and remains below the signal line. A spinning top occurred on the candles. Such formations occur when there is little activity on the trading day; such candles typically have a small real body which also shows the indecisive behavior of the market participants.

All and all, given the consolidation that has continued, the analysis remains on similar lines for Tuesday. Despite the markets showing strength and showing no intention to correct, the actual breakout has not taken place as yet; this should not be anticipated, and we should ideally wait for it to actually happen before getting aggressive in new purchases. On the other hand, with no signs of even a modest correction, aggressive shorts should be avoided. While the markets stay in a range and consolidate, a cautious approach with modest exposure levels is advised for the day.

This was first published by The Economic Times.

Milan Vaishnav, CMT, MSTA

Consulting Technical Analyst

Member: (CMT Association, USA | CSTA, Canada | STA, UK) | (Research Analyst, SEBI Reg. No. INH000003341)

Categories

RECEIVE FREE! – Weekly Market Outlook and all Special Articles when published