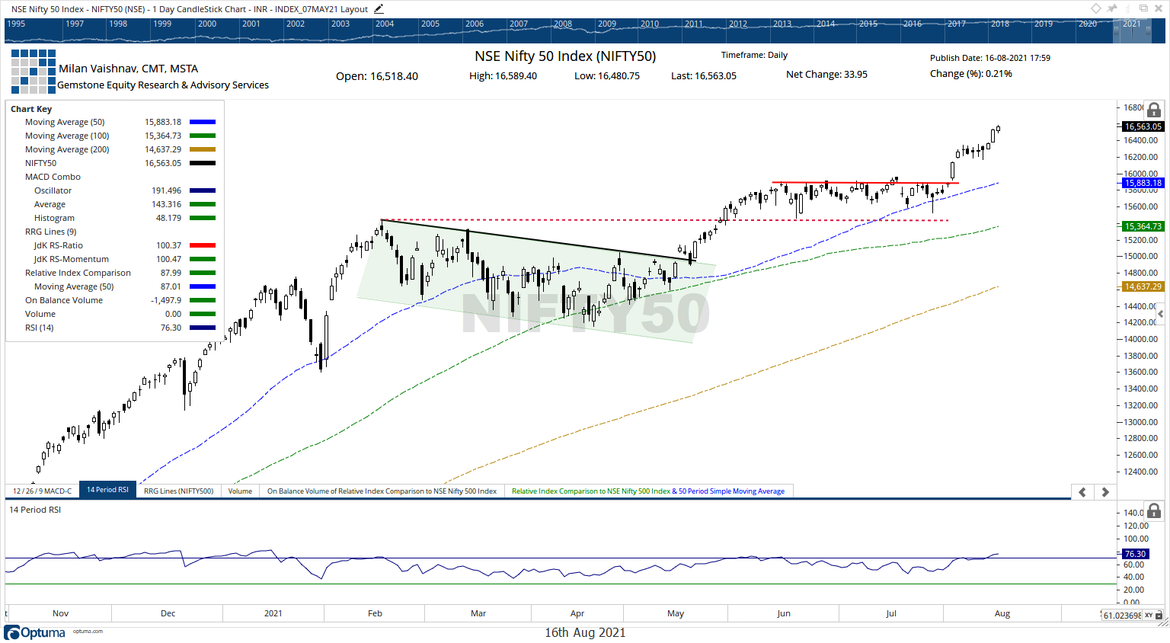

The show of internal strength continued in the Indian markets as the NIFTY inched higher and ended once again to a new lifetime high point. The markets saw a tepid start to the day but they ended up staying resilient to the Asian weakness. The NIFTY saw a flat start to the day and soon drifted in the negative territory. In these early minutes of the trade, the Index marked its intraday low point. The markets soon crawled back inside the positive zone. After that, for the rest of the session, it traded in a limited and capped range, but it continued to maintain its modest gains as well. The benchmark index ended with a net gain of 33.95 points (+0.21%).

The only concern for the markets is that NIFTY is now a bit overbought on the daily charts. This may cause the markets to consolidate; apart from that, the underlying strength remains absolutely intact. This is further evidenced by the high PUT writing that was seen at 16500 levels. This means that if the NIFTY sees some corrective move, it is more likely to consolidate and find buying at lower levels. NIFTY showing a major corrective move is unlikely going by the F&O data unless there is a tactical change in it. So long as the NIFTY keeps its head above 16450-16500, it will consolidate with a positive bias.

The volatility inched higher; INDIAVIX rose by 3.60% to 13.4575. Tuesday is likely to see the levels of 16600 and 16635 acting as potential resistance points; the supports are likely to come in at 16500 and 16455 levels.

The Relative Strength Index (RSI) is 76.30; it has marked a new 14-period high which is bullish. RSI is in the overbought zone, but it remains neutral and does not show any divergence against the price. The daily MACD is bullish and stays above the signal line. Apart from a white body that emerged, no other major formation was seen on the candles.

Going by the present technical setup, it is beyond doubt that the NIFTY is showing a strong undercurrent. However, keeping the overbought conditions in view, we recommend vigilantly protecting profits on existing positions. Using trailing stop-losses is advised to protect profits. While avoiding shorts, all fresh purchases should be kept focused on those stocks/sectors that are expected to improve their relative strength against the NIFTY and start correcting their relative underperformance. A cautiously positive outlook is advised for the day.

This was first published by The Economic Times.

Milan Vaishnav, CMT, MSTA

Consulting Technical Analyst

Member: (CMT Association, USA | CSTA, Canada | STA, UK) | (Research Analyst, SEBI Reg. No. INH000003341)

Categories

RECEIVE FREE! – Weekly Market Outlook and all Special Articles when published