Heavy consolidation continued in the markets as the NIFTY traded in a range and ended the day on a modestly positive note. The markets saw a resilient but quiet opening on the expected lines. It opened positive and got stronger in the first hour of the trade while it marked its high point. However, in the first half of the session, it gradually pared all its gains to slip in the negative. The index recovered in the late afternoon trade and crawled back inside the positive territory. The benchmark index closed with a modest gain of 20.05 points (+0.12%).

Though there are no distinct signs of any major corrective move, the current technical setup suggests that the ranged consolidation may continue. The levels of 16300, if taken out, may fuel a fresh rally. However, until this happens, this point will continue to offer resistance as high Call writing is evident on this level. The volatility remained unchanged; the INDIAVIX remained at the same levels losing 0.01% only. The NIFTY’s behavior against the price level of 16300 needs to be closely watched in the immediate near term.

Tuesday is again likely to see a quiet start to the day. The markets are likely to stay largely resilient and range-bound. The levels of 16320 and 16400 will act as resistance points. The supports will come in at 16200 and 16130 levels.

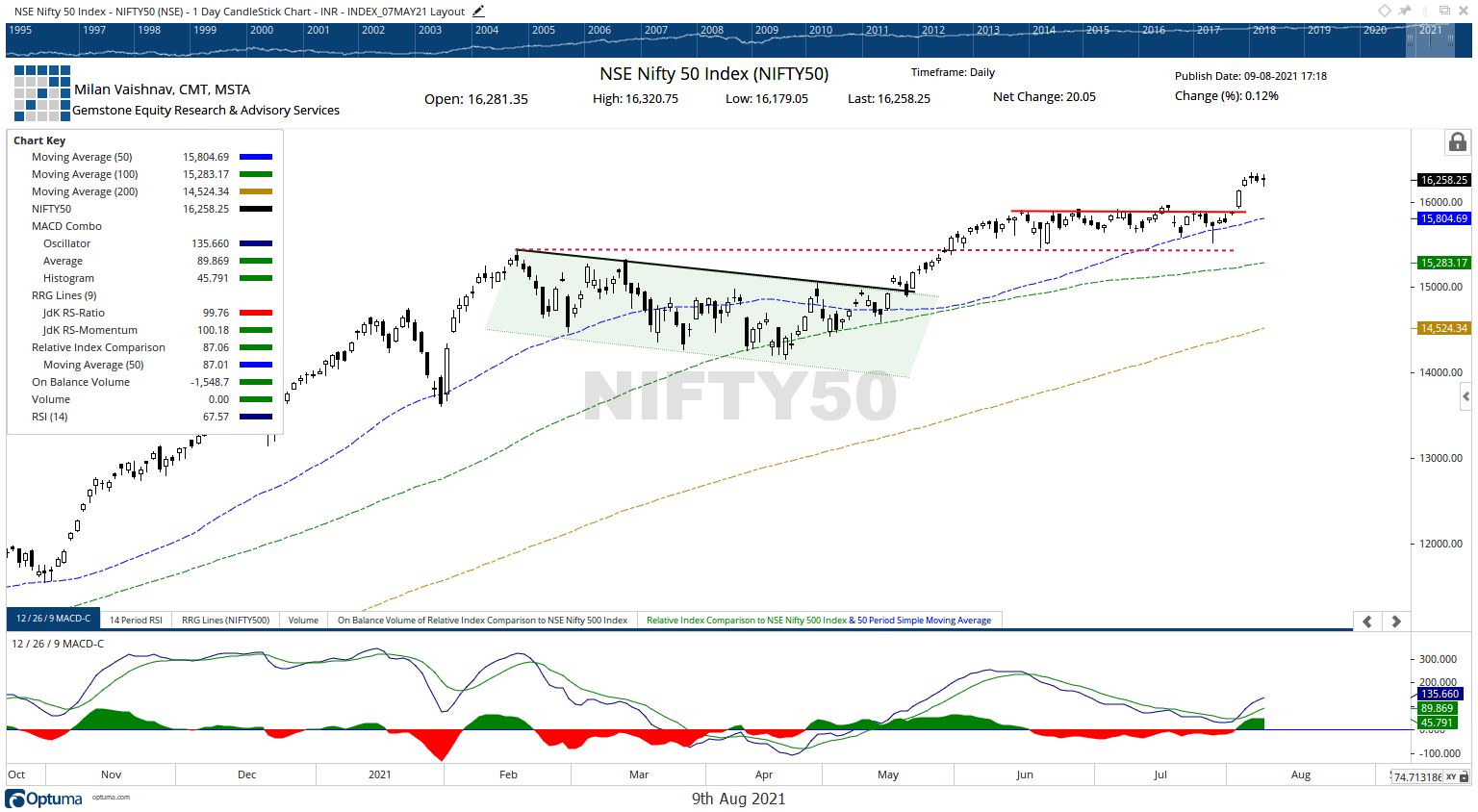

The Relative Strength Index (RSI) on the daily chart is 67.57; it continues to remain neutral and does not show any divergence against the price. The daily MACD is bullish and remains above the signal line. A spinning top occurred on the candles. Spinning tops are formed if there is very little difference between the open and the close levels. They form a small real body and are a result of a lack of directional consensus among the market participants.

The pattern analysis shows that the breakout that happened after the NIFTY took out the 15900-15950 levels has sustained nicely. Instead of correcting, the markets are consolidating near their high point, and this shows the internal strength of the markets as of now.

All in all, we keep the analysis on similar lines. We reiterate that while approaching such technical setups in the markets, one should avoid aggressive shorts. All purchases must be kept limited to defensives and in large-caps as the broader markets may continue to underperform. The Banknifty relatively outperformed the broader markets and may continue doing so over the coming days.

This was first published by The Economic Times.

Milan Vaishnav, CMT, MSTA

Consulting Technical Analyst

Member: (CMT Association, USA | CSTA, Canada | STA, UK) | (Research Analyst, SEBI Reg. No. INH000003341)

Categories

RECEIVE FREE! – Weekly Market Outlook and all Special Articles when published