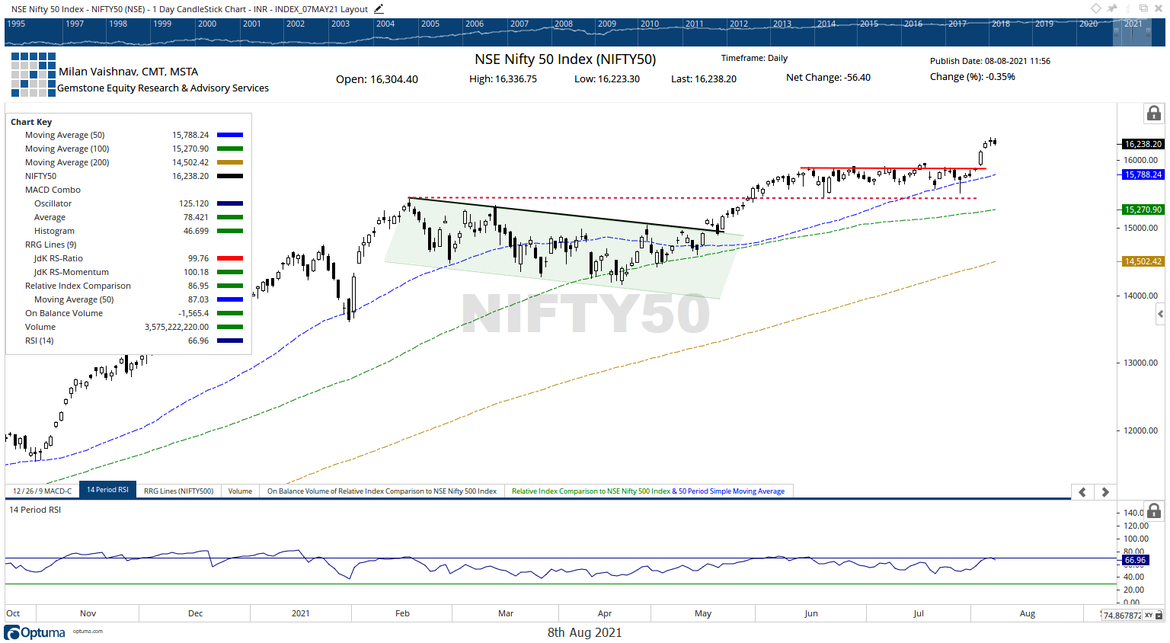

It was a day of consolidation once again for the Indian markets as they traded in a capped range and ended with a modest loss. The NIFTY opened on a positive note. It traded positive and got stronger in the first hour of the trade while it marked its intraday high point. However, gradually, by afternoon, it slipped in the negative territory while paring its opening gains. It spent the rest of the session trading in a very defined and narrow range and did not make any directional headway. The headline index ended with a modest loss of 56.40 points (-0.35%).

The new week may well start on a quiet note; we are all likely to see the NIFTY trading in a range-bound fashion and consolidate. As mentioned before in the earlier notes, following a breakout, the NIFTY has pulled its support levels higher at 16000. So long as the Index stays above this point, it will remain under a broad consolidation. The markets are showing exemplary strength as it is showing no signs to undergo corrections. The volatility continued sliding lower; INDIAVIX declined by 2.06% to 12.6075.

Monday is likely to see a quiet start to the day. We will see the markets consolidating with the levels of 16280 and 16350 acting as resistance points. Supports come in at 16180 and 16100 levels.

The Relative Strength Index (RSI) on the daily chart is 66.96; it stays neutral and does not show any divergence against the price. The daily MACD is bullish and remains above the signal line. Apart from a black body that emerged on the candles, no other formations were noticed.

While the markets in general consolidate, the broader markets including midcaps may see highly selective moves. As the mid and small-cap indexes had run up hard, the broader markets may see more pain on a relative basis if the markets choose to consolidate within a broad range again.

Given the present technical setup, we strongly suggest avoiding aggressive shorts. While on the long side, we recommend continuing to stay highly selective. Fresh purchases may be kept on defensives like IT and FMCG. Apart from this, more focus should be on the large caps and on individual stocks with good technical setups. Overall, a cautiously positive approach is advised for the day.

This was first published by The Economic Times.

Milan Vaishnav, CMT, MSTA

Consulting Technical Analyst

Member: (CMT Association, USA | CSTA, Canada | STA, UK) | (Research Analyst, SEBI Reg. No. INH000003341)

Categories

RECEIVE FREE! – Weekly Market Outlook and all Special Articles when published