The bearish undertone prevailed on Tuesday as the NIFTY continued to slide, tested its important support levels, but ended on a negative note. The markets saw a negative start to the day and got weaker as the day progressed. At one point in time, the NIFTY slipped below the 15600 levels. The second half of the session saw some recovery coming in from lower levels. While the markets recouped some portion of its loss, the final hour and a half saw weakness returning again. The Index finally ended with a net loss of 120.30 points (-0.76%).

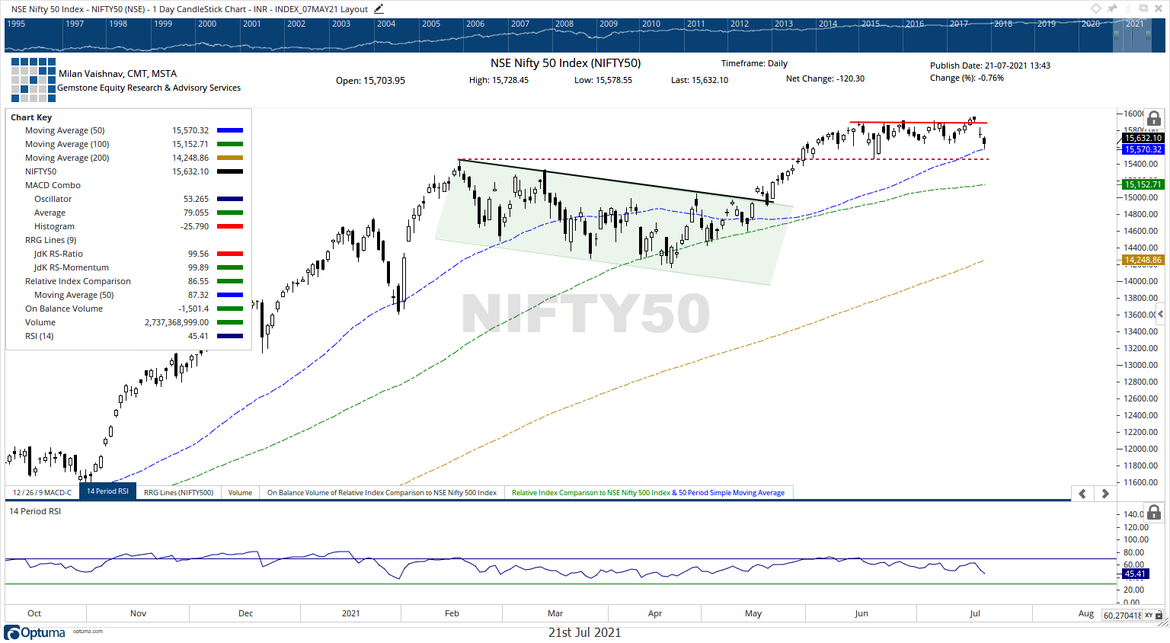

Tuesday’s session saw the NIFTY testing its 50-DMA which presently stands at 15570. Going ahead, in the immediate short-term, this point will act as important support on a closing basis. We also enter the expiry of the weekly options. High Call writing and Put unwinding was seen at 15700 levels; 15800 continues to see the highest Call OI accumulation. On the lower side, 11500 holds maximum Put OI, and it is expected to act as support. If any technical pullback occurs, the levels of 15700 and higher will offer resistance for the markets.

Volatility increased as INDIAVIX rose 4.14% to 13.2050. Thursday is likely to see the levels 15680 and 15765 as resistance. The supports come in at 15570 and 15500 levels.

The Relative Strength Index (RSI) on the daily chart is 45.41; it has marked a new 14-period low which is bearish. RSI, however, is neutral and does not show any divergence against the price. The daily MACD is bearish and remains below the signal line. A black body emerged on Candles; apart from this, no other formations were seen.

The pattern analysis shows that NIFTY has failed to break above the 15900 levels. The index did give an incremental high at 15962, but the breakout failed to give any confirmation. This makes the zone of 15900-15950 an intermediate top for the markets.

Given the two days of decline, there may be some technical pullback in the markets. The opening levels of the NIFTY and the intraday trajectory that it forms will be crucial to determine the trend for the day. However, even if a technical pullback occurs, the upsides will remain very capped above 15700 levels and higher. Watching NIFTY’s behavior vis-à-vis the 50-DMA on a closing basis will also be important. We recommend continuing to approach the markets selectively and with a cautious outlook.

This was first published by The Economic Times.

Milan Vaishnav, CMT, MSTA

Consulting Technical Analyst

Member: (CMT Association, USA | CSTA, Canada | STA, UK) | (Research Analyst, SEBI Reg. No. INH000003341)

Categories

RECEIVE FREE! – Weekly Market Outlook and all Special Articles when published