The Indian equity markets put up a resilient show ahead of the weekly options expiry and ended the day on a positive note. The Index is at the kissing distance of its all-time high point as it approaches the weekly options expiry on Thursday. The markets saw a tepid start to the day and hovered near its first resistance point of 15800. However, after slipping to the lowest point of the day in the morning, the Index recovered over 100-odd points. The headline Index finally ended the day with a net gain of 41.60 points (+0.26%).

Thursday’s trade setup hints at the NIFTY likely attempting their fresh lifetime high levels if the options figures are to be looked at. The levels of 15800 had maximum Call OI concentration at the beginning of the trade. However, that level saw heavy Call unwinding during the day; the maximum CALL OI has now shifted at 16000 levels. This indicates that if the NIFTY is able to sustain above 15800, then it has greater chances of testing the 16000 levels. If the NIFTY fails to be above 15800, then the index may slip under some broad consolidation again.

Thursday is likely to see the levels of 15900 and 15965 acting as resistance points. The supports come in at 11750 and 15700 levels.

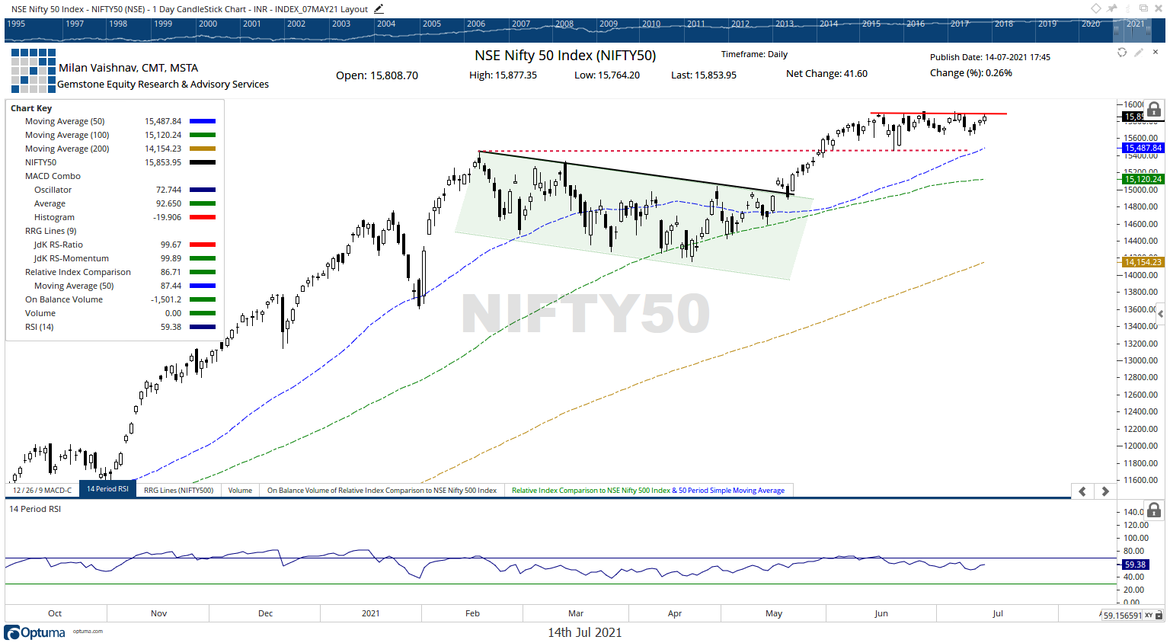

The Relative Strength Index (RSI) on the daily chart is 59.38; it stays neutral and does not show any divergence against the price. The daily MACD is bearish and trades below the signal line.

The pattern analysis shows that after testing the high point of 15915; the NIFTY has consolidated in a sideways trajectory. For a meaningful thrust on the upside, the Index will have to move past this point convincingly.

All in all, the analysis stays on similar lines. It is recommended that before getting aggressive on purchases, it is better to wait for confirmation of the NIFTY moving past the 15915 levels convincingly. The other factor that warrants caution is that even if the NIFTY reports an incremental high, there is very strong resistance at 16000 levels as indicated by the options data. We recommend continuing to be selective and adopt a mindful approach while chasing the momentum on the upside.

This was first published by The Economic Times.

Milan Vaishnav, CMT, MSTA

Consulting Technical Analyst

Member: (CMT Association, USA | CSTA, Canada | STA, UK) | (Research Analyst, SEBI Reg. No. INH000003341)

Categories

RECEIVE FREE! – Weekly Market Outlook and all Special Articles when published