NIFTY continued to consolidate heavily for the fifth day in a row. The markets saw themselves swinging both ways before it ended the day on a flat note. The NIFTY saw a positive start to the day; it opened on a positive note and marked its intraday high in the early minutes of the trade. The markets soon pared their gains and slipped in the negative territory and got weaker as the day progressed. The second half of the session saw the NIFTY recovering smartly from the lower levels. The markets saw a recovery of nearly 130-odd points and ended absolutely on a flat note with a negligible gain of 2.15 points (+0.01%).

The recovery that was seen in the second half of the session was on the back of heavy short-covering. The short covering was evident as the recovery in the markets has come along with a reduction in NIFTY futures OI. NIFTY August futures shed over 5.20 lakh shares or 4.08% in Open Interest. We also have weekly options expiry coming up; the options data show the highest Call OI accumulation at 16300 levels. This point will act as resistance unless the NIFTY opens above and sustains above that point. With the strike of 16200 holding maximum Put OI, this point is likely to provide supports to the markets.

The volatility remained unchanged; INDIAVIX gained 0.06% to 12.7125. Thursday is likely to see the levels of 12330 and 12395 as resistance points. The supports are likely to come in at 12200 and 12170 levels.

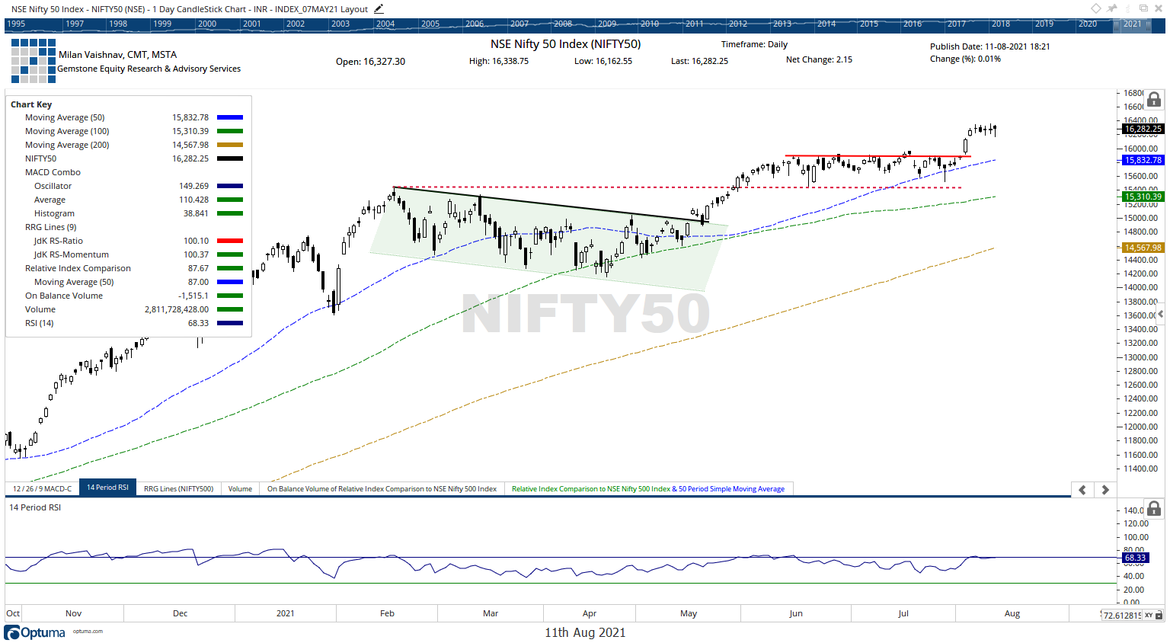

The Relative Strength Index (RSI) on the daily chart is 68.33; it stays neutral and shows no divergence against the price. The daily MACD is bullish and remains above the signal line. A Hanging Man emerged on the candles. It would be crucial to see if the NIFTY moves past 16350 levels.

The pattern analysis shows that the NIFTY has been consolidating for six days in a row after staging a breakout from 15900-15950 zones. The markets have successfully sustained the breakout and have been consolidating near its high point.

The markets recovering from the lower levels on the back of short covering shows discomfort of market participants at lower levels. The markets are expected to resume their up move if the level of 16300 is taken out convincingly. If not, we will see the NIFTY consolidating in a defined range. While staying stock-specific, it is also suggested to continue protecting profits at higher levels unless a definite resumption of uptrend is seen. A cautiously positive outlook is advised for the day.

This was first published by The Economic Times.

Milan Vaishnav, CMT, MSTA

Consulting Technical Analyst

Member: (CMT Association, USA | CSTA, Canada | STA, UK) | (Research Analyst, SEBI Reg. No. INH000003341)

Categories

RECEIVE FREE! – Weekly Market Outlook and all Special Articles when published