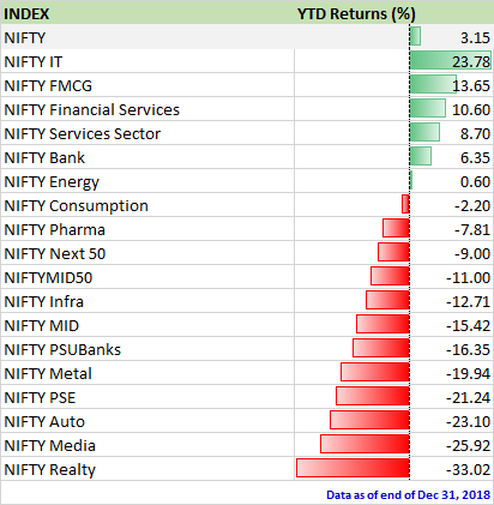

The sector analysis as at end of December 31, 2018, does not paint a pretty picture. Out of 18 Sectors under review, 13 Sectors ended with losses, 1 Sector remained flat and only 5 Sectors reported gains.

If we shift our analysis from pictorial view to actual figures, the table shown above throws up interesting insights.

It shows that NIFTY Realty, Media and Auto Index remained the top 3 under-performers as they lost 33.02%, 25.92%, and 23.10% respectively on a YTD basis. While NIFTY IT, FMCG, and Financial Services performed best gaining 23.78%, 13.65%, and 10.60% respectively.

As we step into 2019, we must remember that the coming year is likely to remain extremely stock-specific in nature. Volatility is likely to remain an integral part of the trade as we will face general elections going ahead.

Milan Vaishnav, CMT, MSTA

Consulting Technical Analyst

Member: (CMT Association, USA | CSTA, Canada | STA, UK) | (Research Analyst, SEBI Reg. No. INH000003341)

Categories

RECEIVE FREE! – Weekly Market Outlook and all Special Articles when published