Professional Technical Analysts often argue that if you know your Charts well, you can see much beyond the price. It is sometimes wonderful to see that even if one is not completely aware of the fundamental inputs; Market Participants know it all and it all gets discounted in the price. In other words, Charts reflect all. The fundamentals picture, the psychology, and the consensus of the Market Participants.

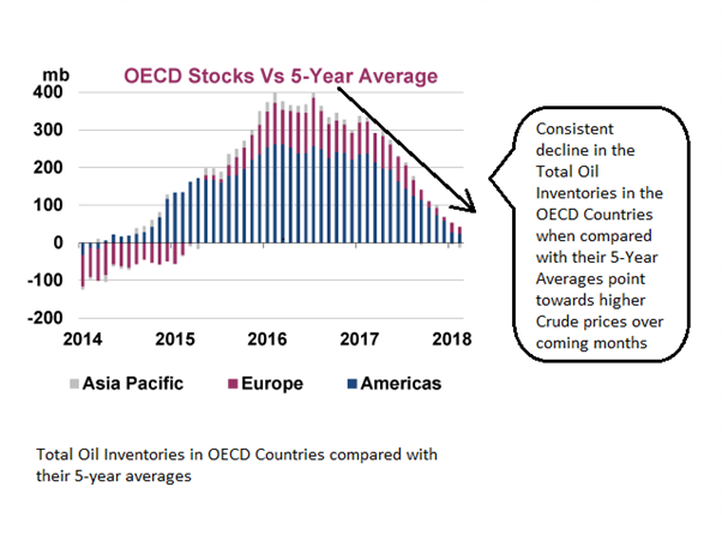

One such good example is the Brent Crude. The below picture shows how the total Oil inventories of the OECD countries peaked in 2016 and after that, it shows how consistently it has dropped ever since. When compared against their 5-year averages, the OECD stocks are seen consistently reducing and very near to getting into negative.

One would not require Einstein’s brain to understand that the glut of stored oil among industrialized economies – which helped keep prices low for years – has shrunk after production cuts by OPEC and Russia. This has not only set prices higher but it is likely to push them higher significantly over the coming week.

This gets wonderfully reflected on the Technical Charts. Let us examine the Weekly Technical Charts of Brent Crude and see how wonderfully it corroborates the above picture and reflects all that we discussed above.

The above Chart gives several indications which point towards an up move in prices of Brent Crude over coming weeks.

The above Chart gives several indications which point towards an up move in prices of Brent Crude over coming weeks.

· A Golden Cross is seen with a 50-Period Moving Average crossing the 200-Period Moving Average from below. This often signals the initiation of a prolonged up-move in prices

· After good accumulation, a big white candle appearing near the 20-Period Moving Average points towards an attempt for a fresh break out.

· On Balance Volume – OBV is moving towards a fresh high while the prices consolidate. This shows inherent buoyancy.

· Prices ended above their upper Bollinger band. Though some temporary retracements inside the bands may be seen, this also points towards the likely initiation of a fresh-up move in prices.

It would be no surprise if we see Crude prices moving higher over the coming weeks.

Milan Vaishnav, CMT, MSTA

Consulting Technical Analyst

Member: (CMT Association, USA | CSTA, Canada | STA, UK) | (Research Analyst, SEBI Reg. No. INH000003341)

Categories

RECEIVE FREE! – Weekly Market Outlook and all Special Articles when published