The Volatility Index – more commonly known as VIX is a measurement of the market’s expected volatility in the future. Analysts and Investors alike look at this tool to measure sentiment while making investment decisions. It reflects market participants’ psychology of greed and fear and it is often referred to as “Fear Gauge” or “Fear Index”.

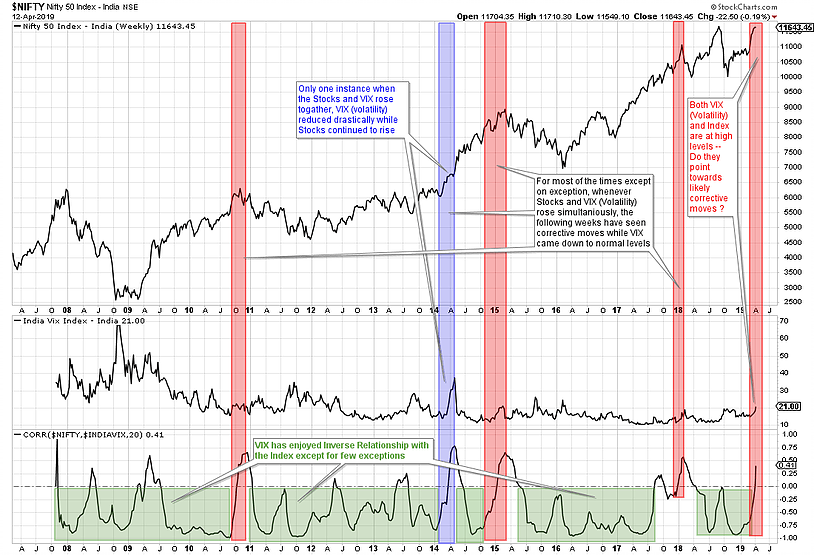

The correlation between Indian VIX and the benchmark NIFTY50 is typically negative. We would always find VIX at its low levels when the index is at its high point and VIX at high levels when the markets are trying to find a bottom.

This was first published by The Economic Times.

Milan Vaishnav, CMT, MSTA

Consulting Technical Analyst

Member: (CMT Association, USA | CSTA, Canada | STA, UK) | (Research Analyst, SEBI Reg. No. INH000003341)

Categories

RECEIVE FREE! – Weekly Market Outlook and all Special Articles when published