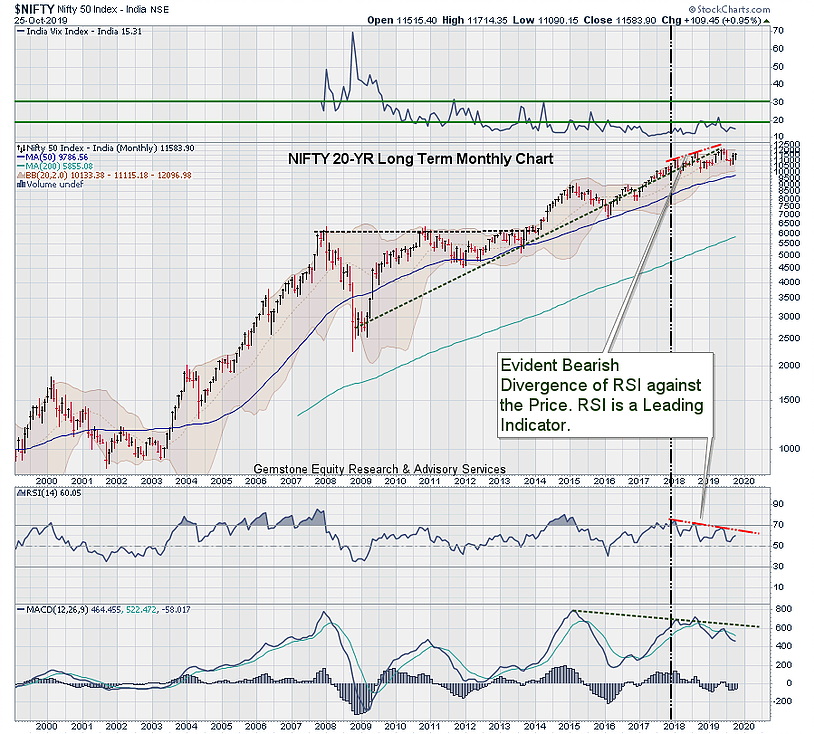

The year that ended today with NIFTY closing at 11583.90 remained quite eventful for the Indian equity markets.

We traditionally wish “Happy and Prosperous New Year,” and the current year remains prosperous in a literal sense. On the last trading day of the current Samvat on 6th November 2018, the NIFTY had ended at 10530. From those levels until today, the NIFTY has gained 1053.90 points, or 10%, which is by far any means a decent gain from any angle.

The year remained thoroughly volatile as the markets faced many events, the major one being the general elections in the mid of 2019. The markets, over and above this, digested virtually two union budgets as the interim budget or the vote-on-account was quite literally as elaborate as the actual budget. The equity markets also dealt with global uncertainties, trade war tensions, and a crude shock that came in following attacks on Saudi Arabia oil attacks. On the positive side, it tasted a couple of doses of reforms, the important one being the rationalization of corporate taxes. The NIFTY also marked its fresh lifetime high this year as well.

Milan Vaishnav, CMT, MSTA

Consulting Technical Analyst

Member: (CMT Association, USA | CSTA, Canada | STA, UK) | (Research Analyst, SEBI Reg. No. INH000003341)

Categories

RECEIVE FREE! – Weekly Market Outlook and all Special Articles when published