The headline index NIFTY presently trades near its life-time high levels and has returned a stellar 15% over the past 12 months and 1.08% on the Year-to-Date basis. Having said this, the loss of momentum and few negative divergences on the leading indicators are quite evident on the charts. It will not be a surprise if the NIFTY takes some breather by correcting modestly or consolidating in a well-defined range.

On the technical landscape, few important changes are taking place which warrants our attention. These three Charts tell a story of a million words!

The whole of 2018 and 2019 have been a year of concentrated gains for the Indian Markets. The gains have been driven by front-line stocks as the Relative Strength of the Midcaps and the Small Caps was under a secular decline. However, things seem to be changing now.

The above is a Weekly NIFTY MIDCap 100 Index ($CNXMID). The Midcap Index has shown a clear breakout as it moved past its 24-month long falling trend line. It is seen ending its multi-yer downtrend as the RS Line, when compared against NIFTY50 appears to be reversing its trend. The RS Line has turned higher, penetrated its 50-DMA which had been acting as its proxy trend line for nearly 2 years. To add to this, the 50-DMA has crossed 200-DMA from below resulting into a Golden Cross.

A similar picture is seen on the Small Cap Index ($CXNSML) Chart. The Small-Cap 100 Index has shown a clear breakout as it moved past its 24-month long falling trend line. It is seen ending its multi-year downtrend as the RS Line, when compared against NIFTY50 appears to be reversing its trend. The RS Line has turned higher, penetrated its 50-DMA which had been acting as its proxy trend line for nearly 2 years.

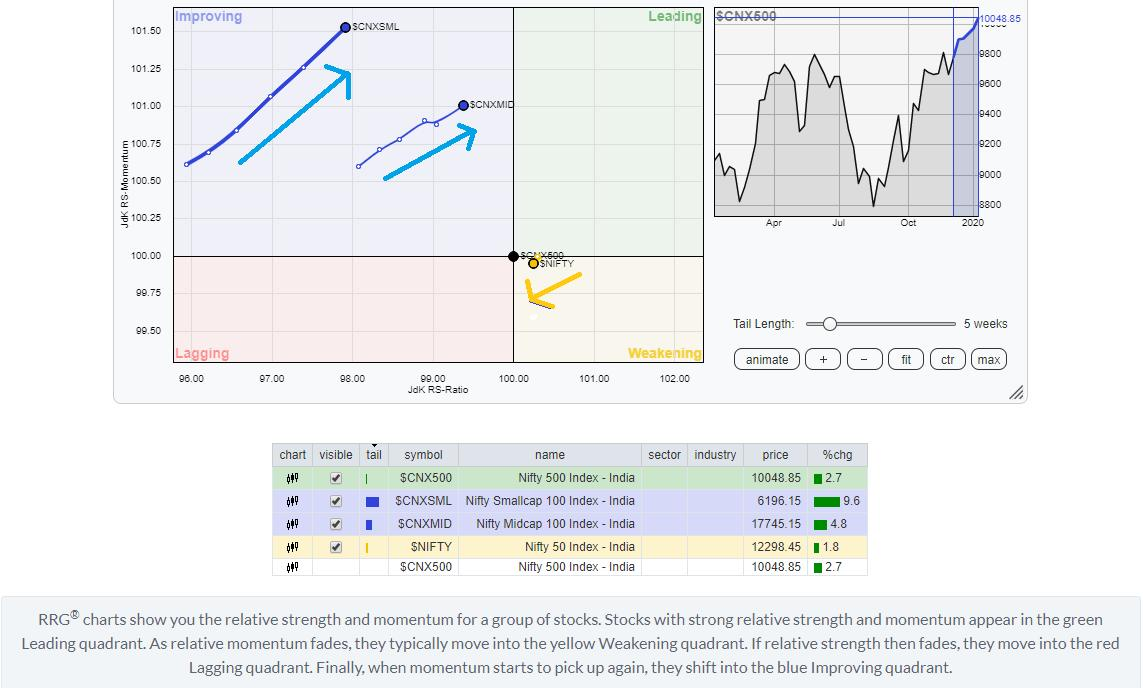

The Relative Rotation Graph (RRG) also paints an interesting picture.

The RRG Chart shown above captures this view. The RRG Chart has the NIFTY MidCap 100 Index, NIFTY Small Cap Index, the NIFTY 50 plotted on it and they are bench marked against the broader NIFTY500 Index ($CNX500). The NIFTY500 Index is also plotted on it but it is just to highlight the center point and it has no other relevance.

It is evident that the NIFTY50 is very near to the benchmark. Anything that is near to the center point, i.e. the benchmark will have a lesser amount of alpha capture potential. Also, the NIFTY50 is seen slipping into the lagging quadrant and has shown signs of topping out.

On the other hand, the NIFTY MidCap 100 and Small Cap 100 index are seen building on their momentum and are firmly placed in the improving quadrant. This is evidence of the fact that they are bottoming out process is completed and this has also resulted in a breakout on the charts above.

Importantly, they are far away from the center point, i.e. the NIFTY 500 Index which is the benchmark. The MidCap and the Small Cap indexes are not just likely to relatively out-perform the broader markets, they are also likely to offer much more alpha capture possibilities than the front line index.

There are possibilities that there may some overall corrective moves in the markets, but it is beyond doubt that the Mid and the Small-cap indexes will relatively out-perform the broader markets.

This reading will remain valid so long as the MidCap 100 index stays above 16900 and the Small Cap Index stays above 5700.

Milan Vaishnav, CMT, MSTA

Consulting Technical Analyst

Member: (CMT Association, USA | CSTA, Canada | STA, UK) | (Research Analyst, SEBI Reg. No. INH000003341)

Categories

RECEIVE FREE! – Weekly Market Outlook and all Special Articles when published