Backed by strong FII inflows, the Indian equity markets continued their unabated surge in November. As the month ends, the markets have gained much more than what it had lost during the meltdown that was triggered by the Coronavirus pandemic.

The equities have stayed buoyant globally to the extent that it has made other asset classes get relatively weaker mid-way of their rotation as they suddenly lost their relative strength against the equities. We saw bonds getting cheaper as the yields spiked, and the Dollar Index stayed perpetually weak for the entire month showing no intent to pull back.

The emerging markets in general and India in particular benefited the most in terms of FII inflows and this made sure that the NIFTY and the broader Market Index NIFTY 500 end at their fresh high point of their lifetime.

The frontline index NIFTY and the broader market index NIFTY500, both remain overstretched and so do all the high beta stocks and sectors that played out on these lines. That being said, with the markets showing no signs of weakness, it makes a prudent case for the investors to shift to a traditionally defensive play as these sectors are showing all the signs of resumption of a fresh move. This ensures that the existing profits of the Investors does not get sharply reduced if there is any corrective move going ahead and while if at all this happens, the defensive components in the portfolio would lend resilience during corrective times, if any.

November showed strong gains in these traditionally defensive plays that include FMCG, Consumption, Pharma Indexes. In the current view, we also include PSU Bank Index, which may not be classified as a defensive play, but is in the process of bottoming out after a prolonged period of underperformance against the broader markets.

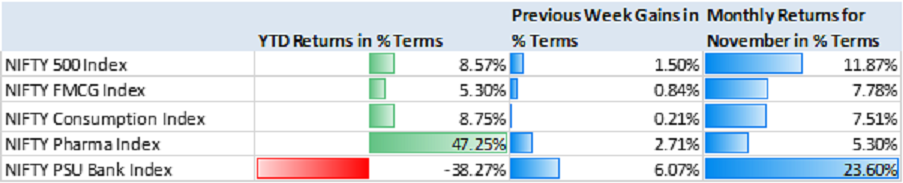

The above table throws interesting insights. Although the weekly gains in the FMCG, Consumption, Pharma and PSU Bank Indexes is moderate to good, the monthly gains have been robust. If we look at the YTD returns, barring the Pharma Index which has returned 47.25% on the YTD basis, the other three sectors have seen bulk of their YTD gains coming in the month of November. The PSU Bank Index, despite gaining 23.60% in November, still shows a net negative return of 38.27% on YTD basis. We expect all these sectors to do much better on relative terms as compared to the broader markets over the coming weeks.

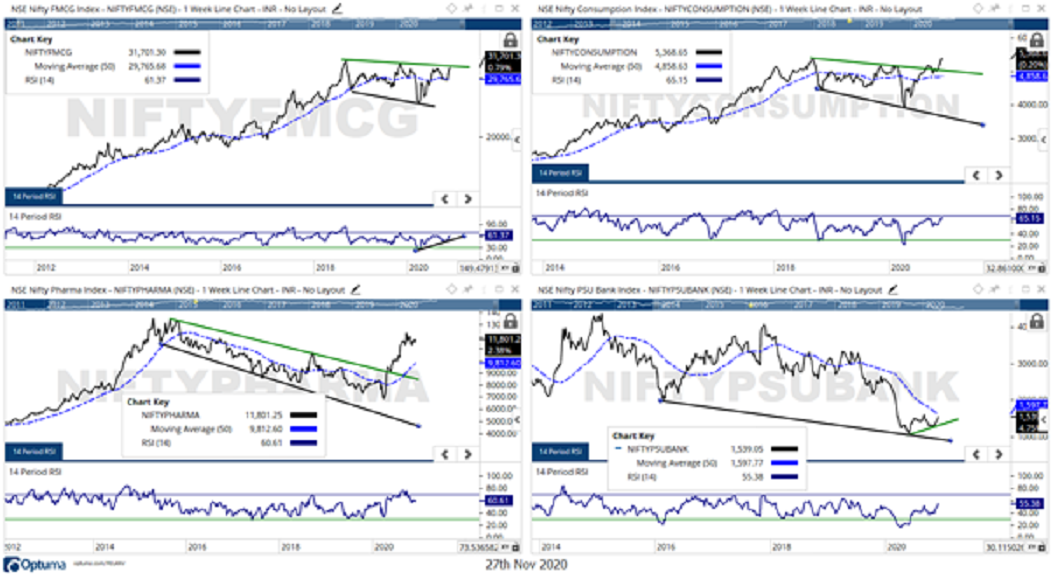

The line charts of the four sectors corroborate this inference drawn as well. While the FMCG index is on the verge of breaking out, the Consumption Index has already shown a breakout. The Pharma Index stays in a strong uptrend following a channel breakout, the PSU Bank Index has shown a strong positive divergence on the RSI and appears to in the process of a strong bottom formation.

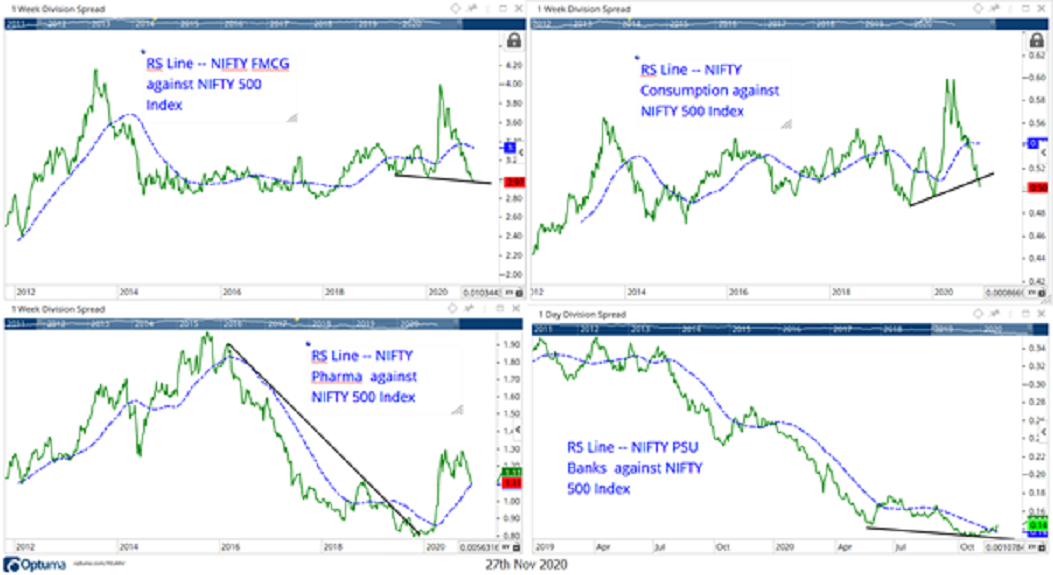

When compared against the broader NIFTY 500 Index, the RS line also support this reading. The RS lines of FMCG and Consumption Indexes have tested their major supports, the RS line of Pharma Index has already confirmed the reversal and has ended its downtrend. The RS line of PSU Bank against the broader NIFTY 500 Index appears to have ended its multi-month downtrend. It has also penetrated its 50-Week MA as a sign of confirmation of this attempted reversal.

Markets, in general, may continue to stay strong despite some consolidation happening at the current levels. With the equity indices overstretched but not showing any signs of giving up, it would make sense to add a layer of protection and stability to the portfolios. Increasing allocation to these sectors may make perfect sense if at all we see some range-bound but sharp corrective bouts from current or higher levels.

This was first published by The Economic Times.

Milan Vaishnav, CMT, MSTA

Consulting Technical Analyst

Member: (CMT Association, USA | CSTA, Canada | STA, UK) | (Research Analyst, SEBI Reg. No. INH000003341)

Categories

RECEIVE FREE! – Weekly Market Outlook and all Special Articles when published