We head into the month which would remain most volatile and eventful as we face one of the most important domestic events – General Election Results.

The equity markets are hovering around their lifetime highs. On one hand, they grapple with a not-so-favorable technical setup as they show persistent bearish divergence against its lead indicators. On the other hand, in event of any favorable election outcome, we might see sporadic sharp up-moves happening. Amid this environment, an interesting rotation is seen happening if we compare PSU Bank Index and BankNIFTY which has primarily private banks as its main constituents.

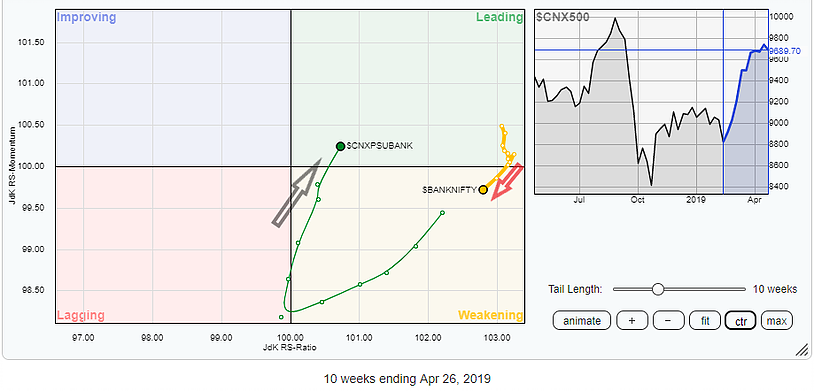

In the above Relative Rotation Graph (RRG), we compare PSUBank Index and BankNIFTY against the benchmark broader market index CNX500. As per the 10-week trail of both indexes, it is observed that BankNIFTY has moved into the weakening quadrant from the leading quadrant. This has happened as BankNIFTY has consistently lost relative momentum over the past 10-weeks.

On the other hand, it is seen that the PSU Bank Index has shown a sharp surge in relative momentum and has crawled back into the leading quadrant. Also, it is worth taking note the PSU Bank Index has bypassed the usual completion of the clockwise cycle.

Under normal circumstances, it would have moved from weakening to lagging quadrant, from lagging to improving quadrant, and only then into the leading quadrant. Instead, it has moved directly from the lagging quadrant to the leading quadrant owing to a sharp improvement in its relative strength and momentum against the broader CNX500 index.The construction of the BankNIFTY index is highly skewed in favor of private sector banks. The top four banks; HDFC Bank, ICICI Bank, Kotak Mahindra Bank, and Axis Bank represent 73.77% of the index. The PSU Bank index, on the other hand, has State Bank of India, Bank of Baroda, and PNB representing over 62.88% of the index.

From the above reading, we cannot directly jump to the conclusion that private banks are set for a decline or PSU banks are set for an up-move. However, we can surely draw one conclusion that PSU banks are set to strongly outperform the private banks on a relative basis over the coming week.

In event of a general decline in the markets, we will see BANKNIFTY taking a much larger hit as compared to PSU banks and in event of an up-move in the markets, the potential upsides in the PSU banks will be much higher as compared to the BANKNIFTY.

Important Note: RRG™ charts show you the relative strength and momentum for a group of stocks. In the above Chart, they show relative performance as against NIFTY500 Index (Broader Markets) and should not be used directly as buy or sell signals.

This was first published by The Economic Times.

Milan Vaishnav, CMT, MSTA

Consulting Technical Analyst

Member: (CMT Association, USA | CSTA, Canada | STA, UK) | (Research Analyst, SEBI Reg. No. INH000003341)

Categories

RECEIVE FREE! – Weekly Market Outlook and all Special Articles when published