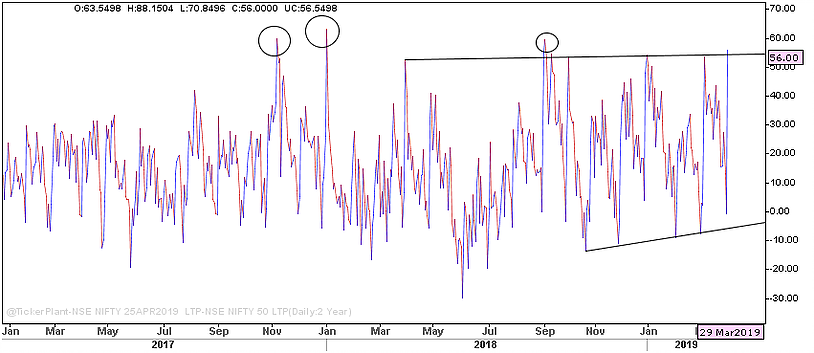

As we know, a futures instrument derives its value from its respective underlying asset. For example, the NIFTY futures instrument derives its value from the NIFTY’s spot price. Though the futures price and the price of its underlying move in the same direction, they do not maintain the same distance from each other. For example, the futures price may be equal to the spot price, but it can also be less than or greater than the spot price. Thus, the futures can be said to be trading at par (equal to the spot price), with a premium (greater than the spot price) or a discount (less than the spot price).

There are many factors that cause the futures to trade either at discount or at premium. These include market sentiment, inflation expectations, economic strength, availability of substitutes, trends, and liquidity, among others.

The general interpretation is that, when the premium increases or widens, the mood in the market is getting incrementally bullish. Just the opposite happens when the premium decreases or discount increases, where the sentiment is said to be getting increasingly bearish.

That being said, we get interesting and important insights to know what happens when a premium reaches certain levels and how it adjusts.

This was first published by The Economic Times.

Milan Vaishnav, CMT, MSTA

Consulting Technical Analyst

Member: (CMT Association, USA | CSTA, Canada | STA, UK) | (Research Analyst, SEBI Reg. No. INH000003341)

Categories

RECEIVE FREE! – Weekly Market Outlook and all Special Articles when published