With strong market breadth, the Indian equities resumed their up move and ended a day with decent gains. The markets saw a positive start to the day on the expected lines. However, after opening positive, the NIFTY slowly drifted lower and at one point in time it pared almost all its gains in the first hour of the trade. However, things picked up again from there and the Index kept steadily marking higher tops during the day. While no volatile moves were seen, the Index slowly kept inching higher and maintained the gains. The headline index finally with net gains of 128.15 points (+0.78%).

The technical highlight of the day was that the NIFTY has successfully bounced off the immediate support area of 16300 levels. Another important thing was the BANKNIFTY Index grossly outperformed the NIFTY on the expected lines. In the previous notes, we had mentioned that BANKNIFTY is lagging in its relative performance and is expected to play catch up. This behavior may well continue through the coming week and we expect this Index to relatively outperform the NIFTY. The volatility slipped again; INDIAVIX ended lower by 3.63% to 13.1875.

Wednesday is likely to see a stable start to the day. The levels of 16685 and 16750 may act as resistance points; supports may come in at 16580 and 16500 levels. It should be noted that the 16500 level holds maximum PUT OI concentration; hence it may act as immediate near-term support for the Index.

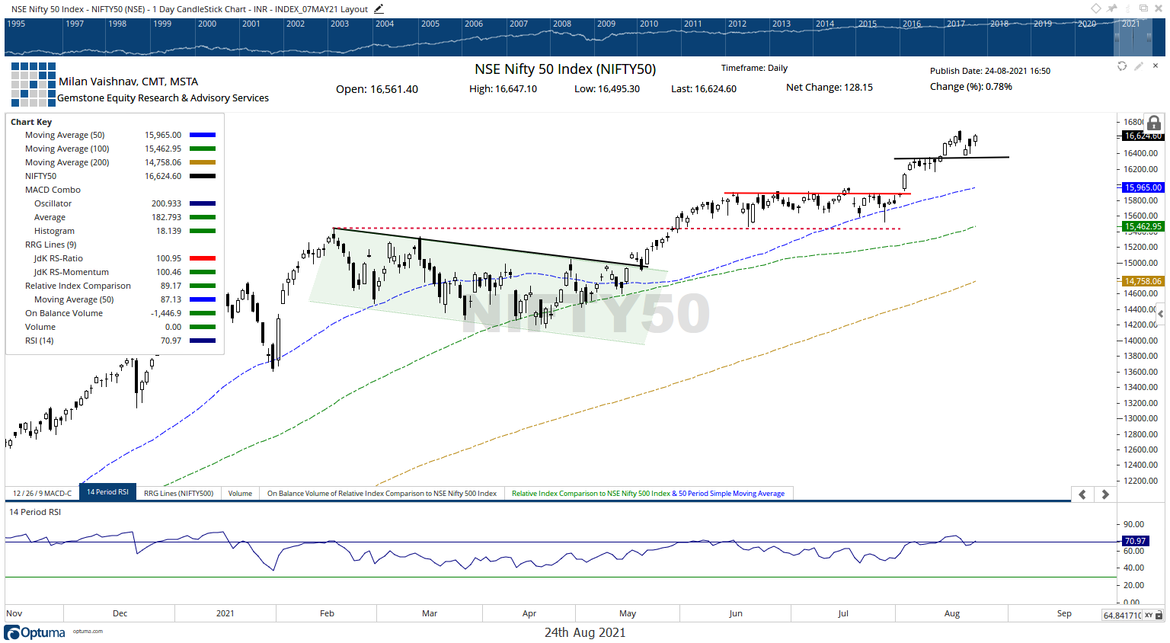

The Relative Strength Index (RSI) on the daily chart is 70.97; it has again mildly drifted in the overbought zone. However, RSI is neutral and does not show any divergence against the price. The daily MACD is bullish and remains above the signal line.

The pattern analysis shows that the most recent congestion zone that the markets created after its original breakout from 15900 levels has lent support to the NIFTY. This area of 16300-16350 is the most immediate near-term support for the markets. However, so far as the original breakout is concerned, the breakout will remain in force so long as the NIFTY is able to keep its head above the 16000 levels.

We also enter the penultimate day of the expiry of the current month derivative series. It is largely expected that the session may stay influenced by the rollovers. The possibility of the large-caps and the laggards to relatively outperform the markets remains in the picture. It is recommended while avoiding shorts, it would be prudent to continue sticking to the large caps while looking for good quality stocks that are in the process of improving their relative strength against the broader markets.

This was first published by The Economic Times.

Milan Vaishnav, CMT, MSTA

Consulting Technical Analyst

Member: (CMT Association, USA | CSTA, Canada | STA, UK) | (Research Analyst, SEBI Reg. No. INH000003341)

Categories

RECEIVE FREE! – Weekly Market Outlook and all Special Articles when published