One more day of fierce consolidation by the NIFTY and yet another day of underperformance by Banknifty. This is pretty much what sums up the day on Tuesday. In line with the overnight global and prevailing Asian trade setup, the NIFTY saw a mildly negative start to the day. Though the index managed to crawl back into the positive territory, it saw some serious profit-taking in the afternoon trade. However, the markets saw recovery coming in which took the NIFTY back in the green. The last hour saw the Index getting stronger and this led to the headline index closing at its new lifetime high again. It posted net gains of 51.55 points (+0.31%).

Thursday is a trading holiday, and because of this, we will have weekly options expiry coming up a day ahead on Wednesday. The F&O data shows the continued addition of PUT OI on 16500 and 16600 shows that NIFTY has shifted its base higher. Any corrective activity will see 16500 playing out as good potential support as it holds maximum PUT OI at that level. Volatility changed little; INDIAVIX declined marginally by 0.33% to 13.4125.

Wednesday is likely to see the levels of 16650 and 16735 acting as resistance points. Supports come in at 16575 and 16500 levels.

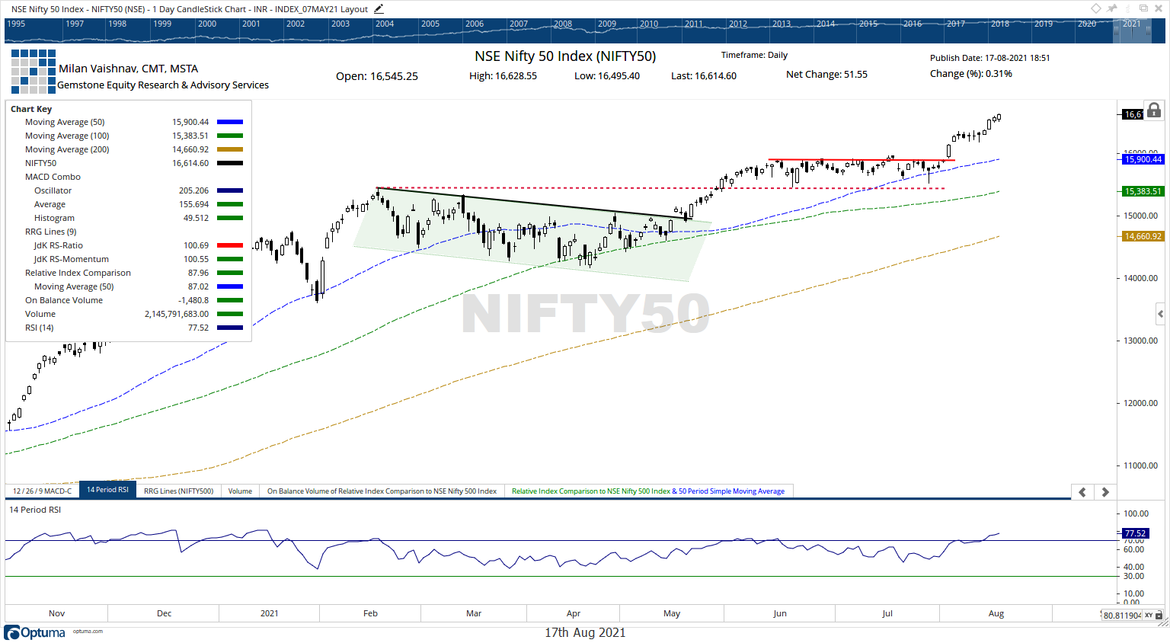

The Relative Strength Index (RSI) on the daily chart is 77.52; it has marked a new 14-period high which is bullish. RSI is in the overbought zone but it does not show any divergence against the price. The daily MACD is bullish and remains above the signal line.

The pattern analysis shows that the NIFTY originally broke above the 15900-15950 zone, then midway consolidated for six sessions and has extended its up move. There are possibilities that it may consolidate a bit at present levels. However, the F&O data suggests that that would be a range-bound consolidation with no major downside moves.

All in all, the continuing feature of the market moves was that Banknifty continued to grossly underperform relative to the front line index. Apart from this, the Realty sector is also seen consolidating following a strong move a couple of days ago. This space needs to be closely watched. It is recommended that at this point in time, rather than chasing the heated stocks, one must lookout for good quality large caps that have either underperformed until now or are showing improvement in their relative strength. Avoid shorts as the underlying strength remains intact.

This was first published by The Economic Times.

Milan Vaishnav, CMT, MSTA

Consulting Technical Analyst

Member: (CMT Association, USA | CSTA, Canada | STA, UK) | (Research Analyst, SEBI Reg. No. INH000003341)

Categories

RECEIVE FREE! – Weekly Market Outlook and all Special Articles when published