While the global trade setup helped, a short covering led move pulled the markets up as the NIFTY closed the day with gains. Despite a favorable trade setup, the NIFTY saw a weaker-than-expected start even if it opened on a positive note. In a range-bound trade in the morning, the Index maintained its gains. The markets grew stronger in the second half of the day and the NIFTY managed to move past the 17800 levels in the final hour of the trade. Following a mild paring of gains, the NIFTY finally ended with net gains of 119.75 points (+0.76%).

NIFTY Options data throw up interesting insights. The levels of 15700, 15750, and 15800 levels saw Put writing; these levels also saw an unwinding of Call Open Interest. Both these things indicate a shift of support higher. On the other hand, the highest Call OI concentration that was seen on 15800 has now shifted back to 16000 levels. All this indicates that the NIFTY may have opened up some more space for itself on the upside; at the same time, the 16000-mark continues to remain a major resistance point for the markets.

The short-covering move may have shifted the supports higher, but the zone of 15850-15900 remains a very stiff resistance area. The levels of 15850 and 15900 are likely to act as resistance points; the supports come in lower at 15730 and 15650 levels.

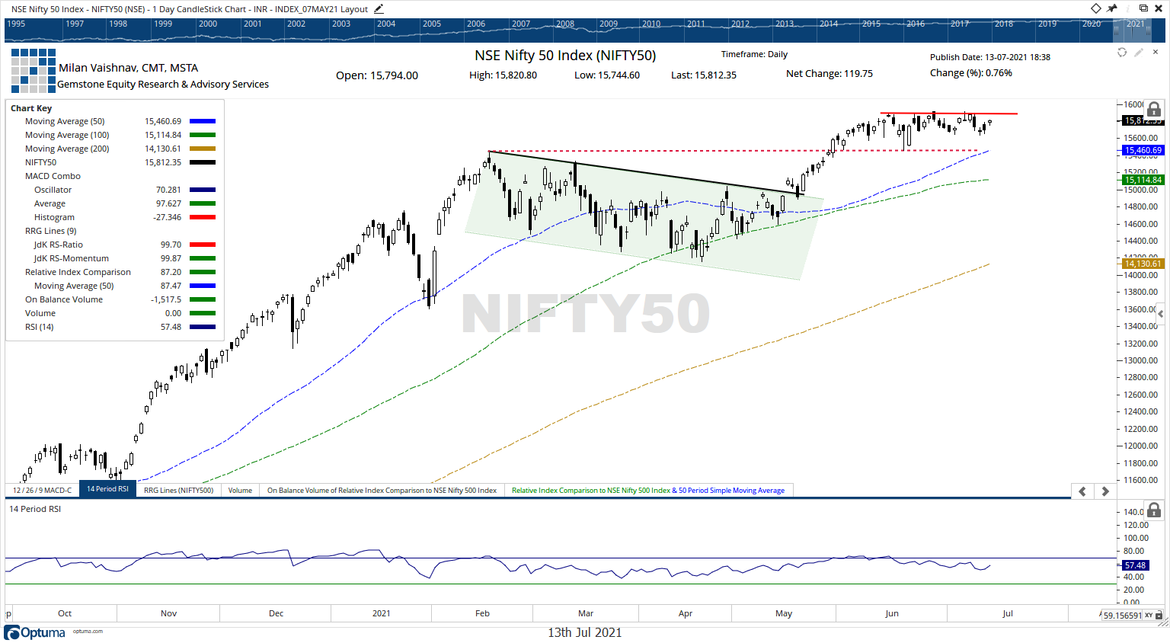

The Relative Strength Index (RSI) on the daily chart is 57.48; it stays neutral and does not show any divergence against the price. The daily MACD is bearish and remains below the signal line.

A spinning top occurred on the candles. Apart from this, no other significant formation was seen on the candles.

The pattern analysis shows that the NIFTY is under a sideways consolidation after testing the levels of 15900 for the first time. Since then, the Index is seen consolidating; unless the NIFTY is able to move past 15900 convincingly any meaningful up-move in unlikely to take place.

The move that was seen in the previous session was because of short covering; this was evident as the NIFTY futures reported a decline of 1.16% or over 1.08 lakh shares in Open Interest. We recommend continuing to stay highly selective and approach the markets with a cautious outlook.

This was first published by The Economic Times.

Milan Vaishnav, CMT, MSTA

Consulting Technical Analyst

Member: (CMT Association, USA | CSTA, Canada | STA, UK) | (Research Analyst, SEBI Reg. No. INH000003341)

Categories

RECEIVE FREE! – Weekly Market Outlook and all Special Articles when published