Much on the expected lines, the Markets extended Tuesday’s breakout and posted incremental gains. The NIFTY saw a positive start to the day and got stronger as the morning session progressed. However, after marking its high point in the late morning session, the NIFTY restricted itself in a defined range. Although it continued to maintain its gains, the index oscillated in a narrow 50-point range throughout the day. In the end, the headline Index closed with a net gain of 128.05 points (+0.79%).

NIFTY has piled up gains of over 350-points in two days following a strong breakout. Also, we have weekly options expiry lined up; this is likely to influence the market moves. While the breakout remains very much valid and continuing, the Options data is throwing up mixed signals. A near-similar Call OI is seen at 16300 and 16400 levels. NIFTY’s behavior against 16300 will decide and dominate the trend for the day on Thursday. NIFTY shows heavy Put writing between 16000 and 16200; this indicates that there are little chances of the markets showing any corrective intent.

Volatility declined again; INDIAVIX came off by 3.89% to 13.2125. Thursday is likely to see the levels of 16300 and 16365 acting as resistance points. The supports come in at 16200 and 16120 levels.

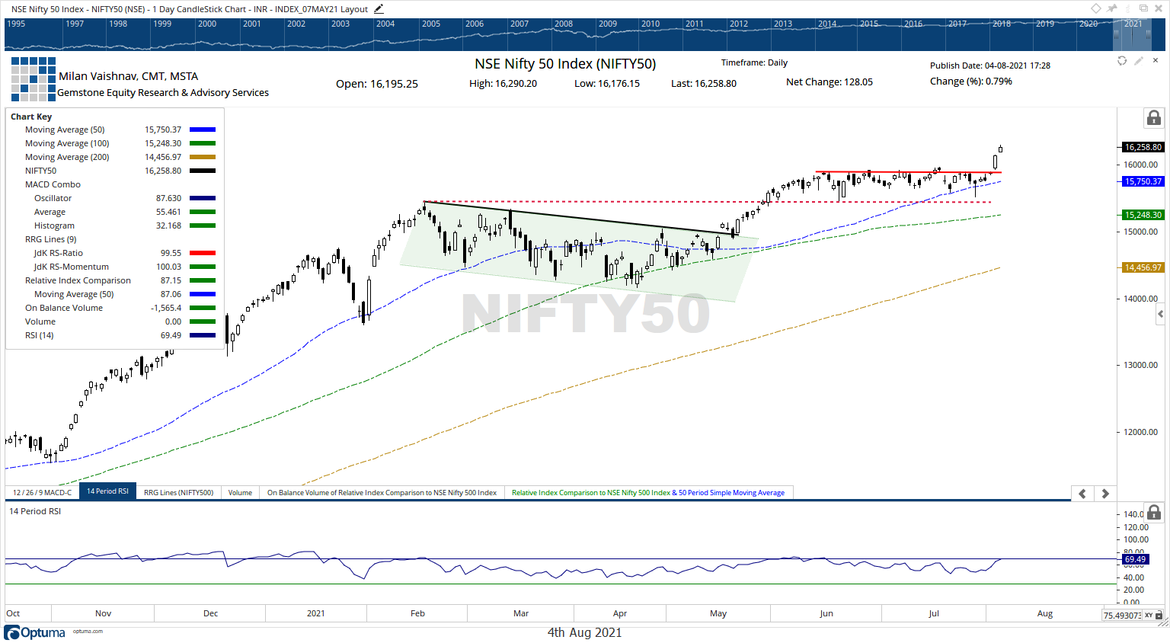

The Relative Strength Index (RSI) on the daily chart stands at 69.49; it has marked a new 14-period high which is bullish. RSI, however, does not show any divergence against the price. The daily MACD is bullish and trades above the signal line.

A rising window occurred on the candles. This results essentially out of a gap and gets resolved usually in the direction of the trend.

All in all, if we look at Wednesday’s up move, it had two characteristics. First, almost the entire up move was driven by financials. Secondly, the broader markets saw some corrective activity. This keeps the analysis for Thursday much on similar lines. We recommend avoiding shorts, but at the same time, also suggest keeping fresh purchases to the defensive large-cap stocks. While continuing to guard profits at higher levels, a cautiously positive outlook is advised for the day.

This was first published by The Economic Times.

Milan Vaishnav, CMT, MSTA

Consulting Technical Analyst

Member: (CMT Association, USA | CSTA, Canada | STA, UK) | (Research Analyst, SEBI Reg. No. INH000003341)

Categories

RECEIVE FREE! – Weekly Market Outlook and all Special Articles when published