After a fierce consolidation of over six days on the daily chart, the markets finally attempted to resume its up move in Thursday’s trade. On anticipated lines and as supported by F&O data, it was mentioned that the move may get extended on the last trading day of the week as well. On the expected lines, the NIFTY surged higher on Friday while extending its gains and ended on a decently positive note. The NIFTY opened higher and got only stronger as the day progressed. The volatility was near-absent throughout the day and the Index remained in a linear upward trajectory showing no signs of any tentative behavior or any intent to correct. The headline index closed with a decent gain of 164.70 points (+1.01%).

Regardless of the markets being overbought on the daily chart, the F&O data suggests a strong build-up of fresh long positions in the markets. The NIFTY August Figures have added over 6.59 lakh shares or 5.08% in Open Interest. The gains coming with net addition in OI indicate the build-up of fresh positions. This also means that in the event of the markets taking a breather, there are greater chances of consolidation in a defined range than any major corrective move. There was significant Put writing seen on 16400; this means that any corrective move will find support here.

Despite no volatile moves seen in the session, volatility increased, and INDIAVIX rose by 4.99% to 12.9900. Monday is likely to see the levels of 16600 and 16630 acting as resistance; supports will come in at 16480 and 16400 levels.

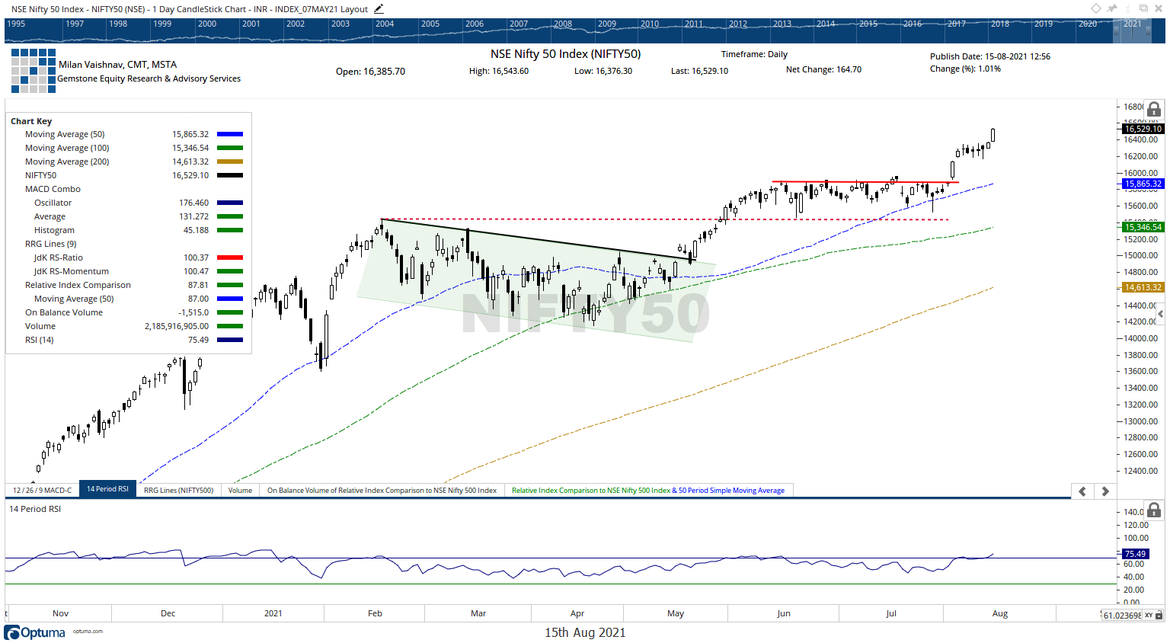

The Relative Strength Index (RSI) on the daily chart is 75.49; it remains in overbought territory. RSI has marked a new 14-period high, but it remains neutral and does not show any divergence against the price. The daily MACD is bullish and stays above its signal line. A strong white body emerged on the candle. This showed the directional consensus of the market participants on the upside.

With the markets closing at yet another all-time high, the NIFTY is now once again in uncharted territory. The F&O data indicate underlying strength and therefore we recommend avoiding aggressive shorts. The new purchases should be still kept stock/sector-specific. There is a higher possibility of the key sectors like Banks, FMCG, IT, etc., continuing to relatively outperform or at least improve on their relative strength. While staying vigilant on existing profits, we recommend using trailing stop-loss to protect gains. A positive outlook is advised for the day.

This was first published by The Economic Times.

Milan Vaishnav, CMT, MSTA

Consulting Technical Analyst

Member: (CMT Association, USA | CSTA, Canada | STA, UK) | (Research Analyst, SEBI Reg. No. INH000003341)

Categories

RECEIVE FREE! – Weekly Market Outlook and all Special Articles when published