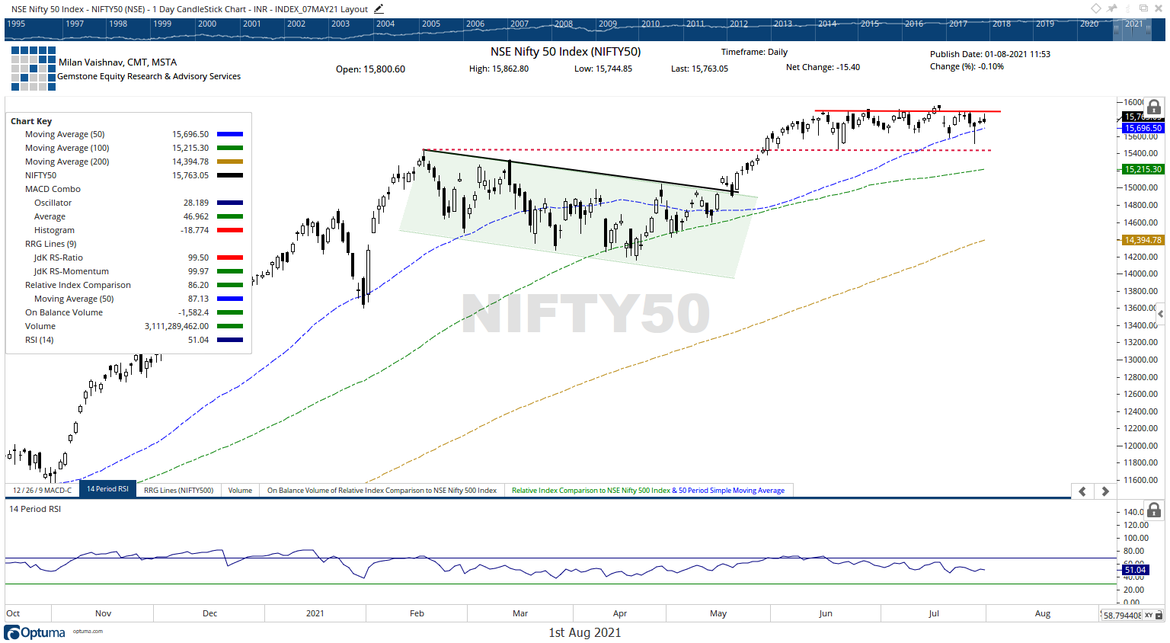

Range-bound consolidation continued in the stock markets for the eighth week as the markets ended the day with a minor loss. The NIFTY went once again near its resistance zone and face selling pressure creeping into the trade once again. The index opened on a modestly positive note. It spent the entire session with limited gains and trading in a sideways trajectory. It got stronger in the afternoon trade; however, it pared all its gains in the last hour of the session. The NIFTY slipped in the negative territory and ended with a minor loss of 15.40 points (-0.10%).

The markets are under fierce consolidation with the levels of 15900-15950 acting as a stiff resistance area. It is clear from the technical perspective that we will not have any meaningful breakout unless this zone is taken out in a meaningful way with volumes. Until that happens, we will see the Index consolidating and facing profit-taking bouts at higher levels. The volatility declined a bit; INDIAVIX came off by 1.10% to 12.8025. The opening of the markets on Monday and the intraday trajectory that it forms will be crucial to decide the trend for the day.

Markets are likely to start on a positive note. NIFTY’s behavior against the price level of 15900 will be crucial to watch. The levels of 15800 and 15885 will act as resistance points. The supports will come in at 15700 and 15650 levels.

The Relative Strength Index on the daily chart is 51.04; it remains neutral and does not show any divergence against the price. The daily MACD is bearish and remains below the signal line. A candle with a long upper shadow occurred. This has once again highlighted the importance of the 15900-15950 zone as an important resistance area to watch for.

The pattern analysis shows that the NIFTY has continued to remain under consolidation. It has stayed in the sideways trajectory for the eighth week in a row. A meaningful breakout can be expected only if the NIFTY moves past the 15900-15950 zone convincingly.

The texture of the markets has started to turn defensive. This is evident from the improvement seen in the traditionally defensive sectors like FMCG, Consumption, and IT. This is likely to continue over the coming days. We recommend now keep purchases not only at modest levels but focused on these defensive sectors like FMCG, Consumption and IT as their Relative Strength against the broader markets is showing signs of improvement. A cautious view is advised for the day.

This was first published by The Economic Times.

Milan Vaishnav, CMT, MSTA

Consulting Technical Analyst

Member: (CMT Association, USA | CSTA, Canada | STA, UK) | (Research Analyst, SEBI Reg. No. INH000003341)

Categories

RECEIVE FREE! – Weekly Market Outlook and all Special Articles when published