Once again after the consolidation of two days, the Indian equities showed their intention of moving higher as it ended near its high point of the day. The NIFTY has been consolidating near 16700; any move higher is supposed to result in some incremental gains for the Index. The NIFTY opened flat but slipped in the negative in the early morning trade while marking its low point of the session. The index soon crawled inside the positive territory and stayed that way throughout the day. The markets maintained their gains in general and ended with a net gain of 68.30 points (+0.41%).

The markets are set to open on a positive note; the global technical setup hints at a positive start to the week. In the Indian context, we are likely to see incremental gains coming in if the NIFTY is able to keep its head above the 16700 levels. Any slip below this point will push the markets into some range-bound consolidation again. The INDIAVIX came off modestly by 0.98% to 13.4050.

Given a possibility of a positive start to the day, the levels of 16730 and 16825 will act as possible resistance points. The supports come in at 16630 and 16585 levels.

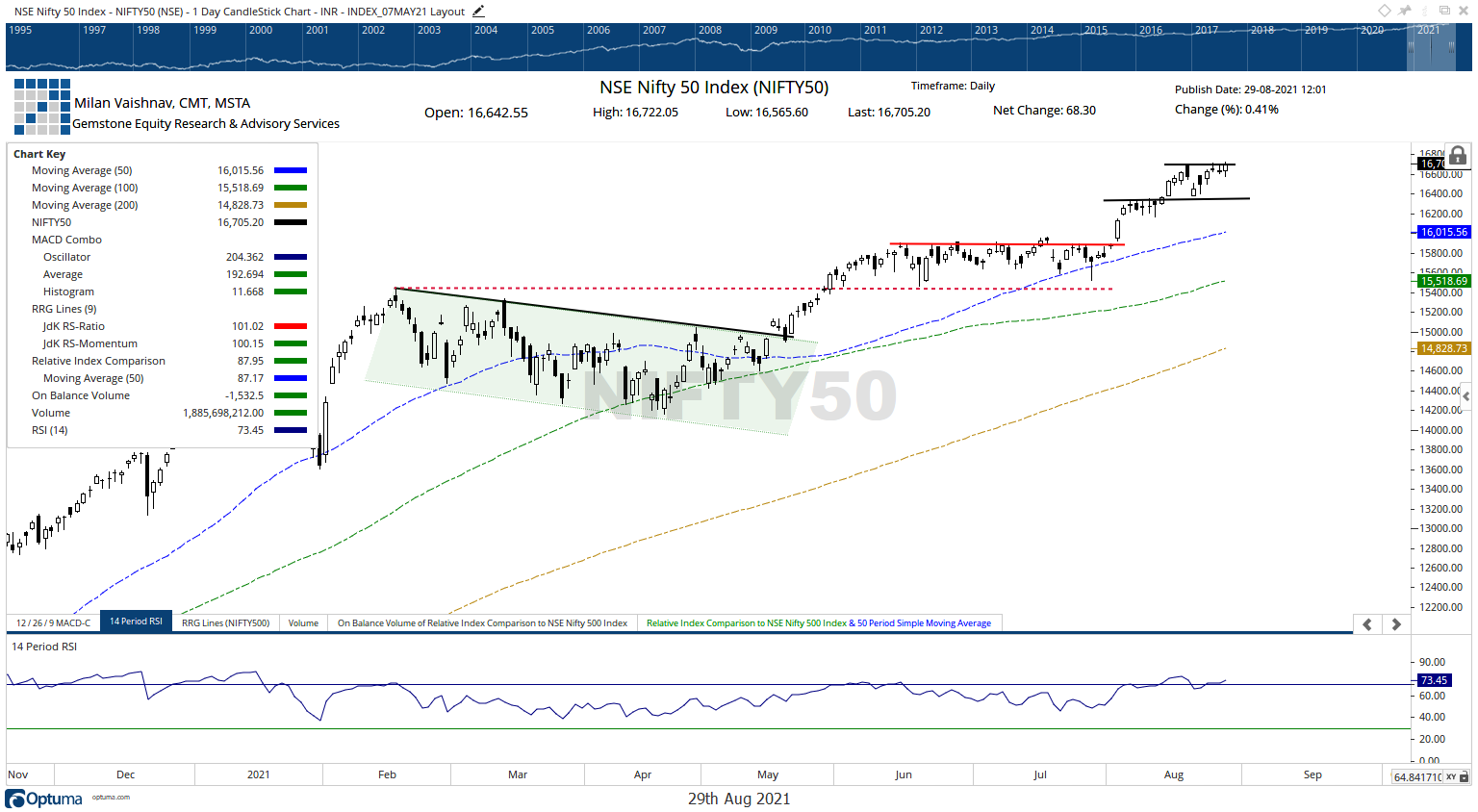

The Relative Strength Index (RSI) on the daily chart is 73.45; it has marked a new 14-period high which is bullish. RSI stays mildly overbought. The daily MACD is bullish as it stays above the signal line. A white body emerged on the candles. Apart from this, no other important formations were noticed.

The pattern analysis shows that the NIFTY remains in a firm uptrend after staging a breakout above the 15900-15950 zone. Following this breakout, there have been few phases of sideways consolidation; the NIFTY has successfully navigated those phases and has kept its uptrend intact. Only a slip below 16500 will push the Index under some consolidation; the breakout though will still remain intact.

All in all, the markets are getting increasingly stock-specific in nature. We recommend continuing to adopt a highly selective approach while approaching the markets. The underperforming sectors, that are key sectors otherwise may show some improvement in their relative performance against the broader markets. It is expected that select Banks and Pharma stocks may show improved relative performance and some select mid-caps can do good as well. However, markets are unlikely to see any sector-specific dominant participant. A cautiously selective approach is advised for the day.

This was first published by The Economic Times.

Milan Vaishnav, CMT, MSTA

Consulting Technical Analyst

Member: (CMT Association, USA | CSTA, Canada | STA, UK) | (Research Analyst, SEBI Reg. No. INH000003341)

Categories

RECEIVE FREE! – Weekly Market Outlook and all Special Articles when published