As the consolidation continued, the Indian equity market refused to stage a breakout and ended the day on a flat note after spending the day in a capped range. The NIFTY opened on a positive note and formed its intraday high in the early minutes of the trade. After trading briefly in a limited zone, the index slipped inside the negative territory. The markets did not make any headway on either side and oscillated in a defined range throughout the day while staying in a sideways trajectory. The headline index finally ended flat with a negligible loss of 0.80 points (-0.01%).

Despite the fact that we are seeing the markets consolidating with a positive bias, the present technical structure and the options data suggest that we should not be anticipating or taking the potential breakout for granted. It will be more prudent to let the breakout actually happen rather than getting preemptively aggressive. The NIFTY Futures for the July series have shown a shedding of OI by over 3.08 lakh shares or 3.16%. The maximum Call OI concentration remains firm at 16000 levels. Volatility dropped another 4.60% and now INDIAVIX remains at precariously low levels.

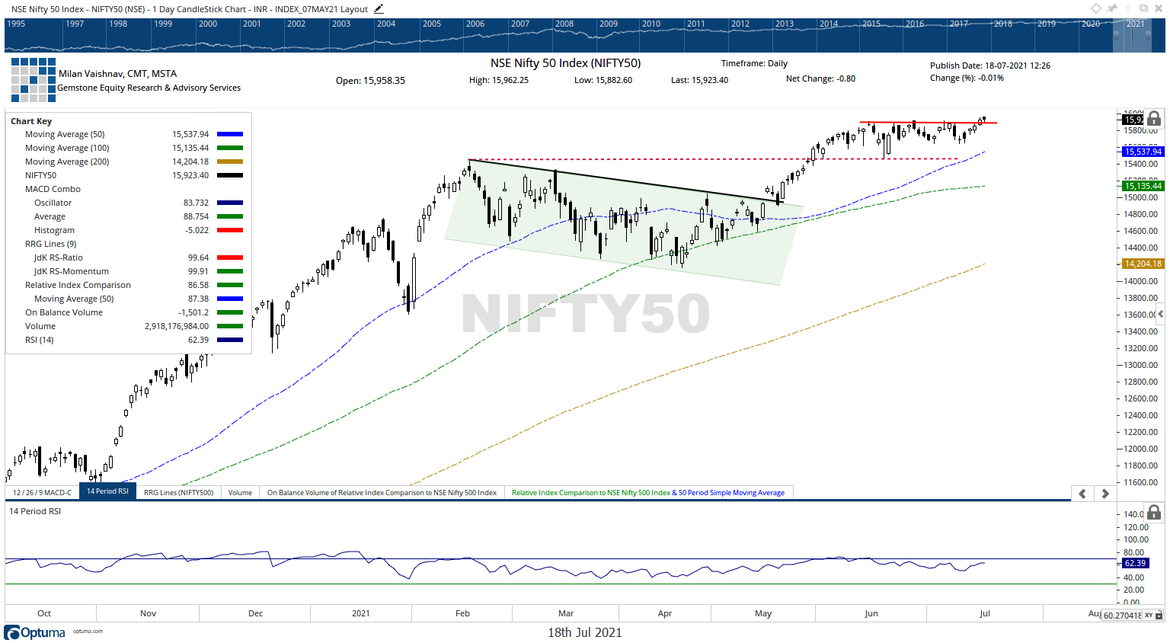

Markets may see a somber start to the day. The levels of 15960 and 16000 will act as resistance points. The supports come in at 15860 and 15800 levels.

The Relative Strength Index (RSI) on the daily chart is 62.39; it continues to show a strong bearish divergence against the price. The daily MACD is bearish and remains below the signal line. Apart from a black body that occurred on the Candles, no other major formations were seen on the charts.

The pattern analysis shows that the NIFTY did mark an incremental high near 15960 levels; however, it has not given any clean and clear breakout from its prior high point of 15915. Unless this level is taken out convincingly, we will not see any sustainable breakout happening.

Despite the NIFTY staying precariously at its high point, there are no signs as yet that suggest any major impending weakness. At the same time, with the breakout not taking place evidently, we recommend continuing to stay high stock-specific and selective while approaching the markets. While shorting should be avoided until a sign of failure to breakout appears, profits on long positions should be vigilantly protected at higher levels.

This was first published by The Economic Times.

Milan Vaishnav, CMT, MSTA

Consulting Technical Analyst

Member: (CMT Association, USA | CSTA, Canada | STA, UK) | (Research Analyst, SEBI Reg. No. INH000003341)

Categories

RECEIVE FREE! – Weekly Market Outlook and all Special Articles when published