It was the second day when the markets traded with a corrective intent and ended the day with minor losses. The NIFTY saw a soft start to the day and the Index marked its intraday low in the early morning session. The morning session also saw the markets pulling themselves back from the low point. Some recovery was pared again and after that the NIFTY spent the entire session moving sideways in a limited and defined trajectory. The NIFTY did not make any major headway and took no directional bias. The headline index finally ended with a net loss of 38.10 points (-0.24%).

While continuing to stay in a broad trading range, the markets may see a positive start and it is also likely to see some mild technical pullback. However, sustainability of such likely pullbacks is important; it would be crucial to see the intraday trajectory that the markets form after opening as that would dominate the trend for the day. Volatility took a hit; INDIAVIX came off by 4.55% to 12.9425 to once again near its lowest levels seen in the near past.

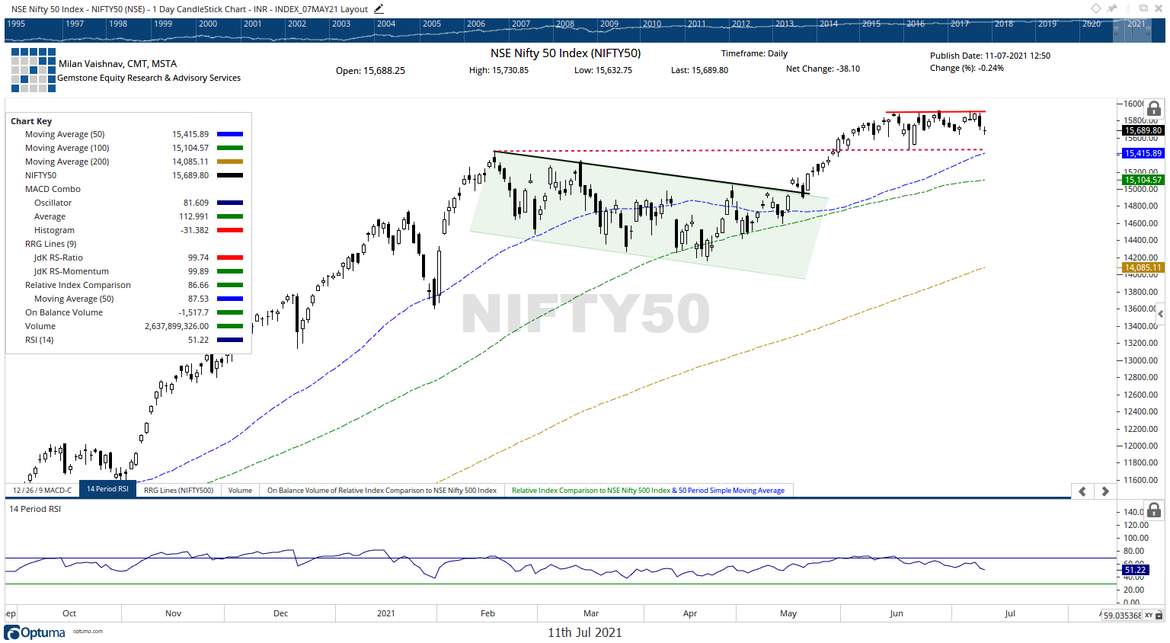

The zone of 15850-15900 continues to stay a major resistance zone for the markets. Monday may see the levels of 15745 and 15780 as potential resistance points. The supports come in at 15600 and 15550 levels.

The Relative Strength Index (RSI) on the daily chart is 51.22; it has formed a fresh 14-period low which is bearish. RSI stays neutral and does not show any divergence against the price. The daily MACD is bearish and remains below the signal line. A spinning top occurred; this reflects a lack of directional consensus among the market participants.

The pattern analysis shows the NIFTY forming a potential top in the 15850-15900 levels; unless these levels are taken out convincingly, the markets will continue to consolidate and will stay prone to profit-taking bouts.

All and all, although the NIFTY is likely to see a positive start and may experience a technical pullback, we recommend not chasing any positive start of the trade. Instead, it would be rewarding to stay stock-specific in the approach. The sectoral trends may be absent but the are possibilities of defensive pockets showing improved relative strength against the broader markets.

This was first published by The Economic Times.

Milan Vaishnav, CMT, MSTA

Consulting Technical Analyst

Member: (CMT Association, USA | CSTA, Canada | STA, UK) | (Research Analyst, SEBI Reg. No. INH000003341)

Categories

RECEIVE FREE! – Weekly Market Outlook and all Special Articles when published