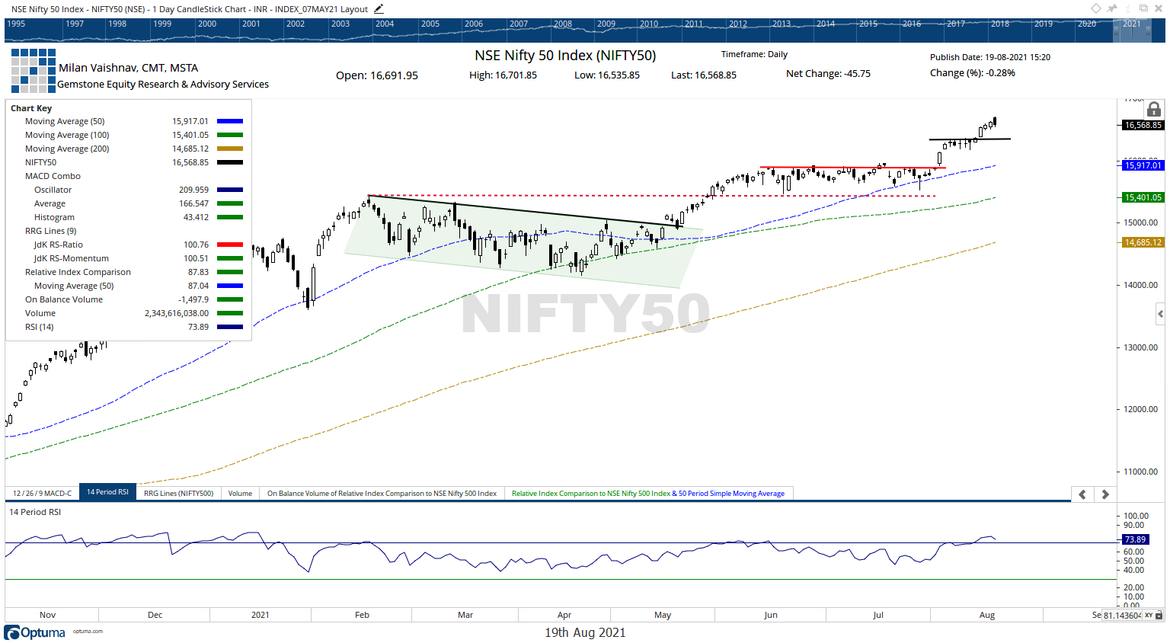

The markets showed first signs of taking a breather as it opened positive, got stronger, but came off from its high point to end in the negative. Following a positive start to the day, the NIFTY got stronger and post yet another new lifetime high for itself. It maintained steady gains in the morning session; however, by the time afternoon approached, the index had pared those gains and slipped in the negative. The corrective pressure increased in the last hour of the trade and the markets showed no intention to recover from its low point. After coming off nearly 170-odd points from its high point, the NIFTY ended with a net loss of 45.75 points (-0.28%).

Markets are staring at two definite things as it approaches Friday’s trade. The NIFTY would open following a gap of one trading holiday; we will find the markets adjusting to the global trade. The global trade setup is weak and this will see the Index opening with a gap down. However, at the same time, we strongly expect the NIFTY to open near its strong support zone of 16300-16350; therefore, it is also strongly expected that the domestic markets will show resilience to the global weakness and may perform relatively better.

The NIFTY PCR across all expiries that had gone very near to 1.80, has come down to 1.29, which is a healthy sign. Friday will see the zone of 16300-16350 working out as potential supports.

The Relative Strength Index (RSI) on the daily chart is 73.89; it stays neutral and does not show any divergence against the price. RSI continues to remain mildly overbought. The daily MACD is bullish and above its signal line. A dark cloud occurred on the candles. This has the potential to stall the present rally and push the markets in some consolidation.

We are likely to see sharply divided behavior between the stock on Friday. With the gap-down opening nearly imminent, the key thing will be to see how resilient the domestic markets may remain to the global weakness. Given the present technical setup, we may see the broader markets continuing to underperform the frontline NIFTY. It is also expected that the stocks that have run up too hard may also see some violent shakeouts. On the other hand, some banks, the Banknifty index, per se, and few defensive stocks like Pharma and FMCG may continue to show resilience to the weakness. We recommend avoiding short the markets and use the downside move to pick up good quality stocks while putting strict protective stops in place.

This was first published by The Economic Times.

Milan Vaishnav, CMT, MSTA

Consulting Technical Analyst

Member: (CMT Association, USA | CSTA, Canada | STA, UK) | (Research Analyst, SEBI Reg. No. INH000003341)

Categories

RECEIVE FREE! – Weekly Market Outlook and all Special Articles when published