While trading much on the anticipated lines, the Indian stock markets consolidated but still went on to end on a positive note. Markets saw a modestly positive start to the day. However, NIFTY soon drifted in the negative territory in the first hour of the session while it marked its low point for the day. By afternoon, the markets managed to crawl back into the positive territory. It grew stronger as the day progressed but came off its high point in the last hour of the trade. The headline index finally managed to end the day with a net gain of 35.80 points (+0.22%).

The expiry of the weekly options played out within the defined lines. The level of 16300 continued to see maximum Call OI concentration; this prevented the NIFTY from sustaining above this point. The maximum Call OI for the coming week is seen at 16300 followed by 16500; this hints at likely opening up of further upsides by the markets. However, NIFTY will attempt moving higher only if it is able to move past 16300 and sustain above that level. If NIFTY struggles around this point of 16300, we will see the NIFTY consolidating once again in a defined range.

Volatility continued to drift lower; INDIAVIX declined by 2.57% to 12.8725. Friday is likely to see a tepid start to the day. The levels of 16325 and 16390 will act as resistance points. The supports come in at 16180 and 16120 levels.

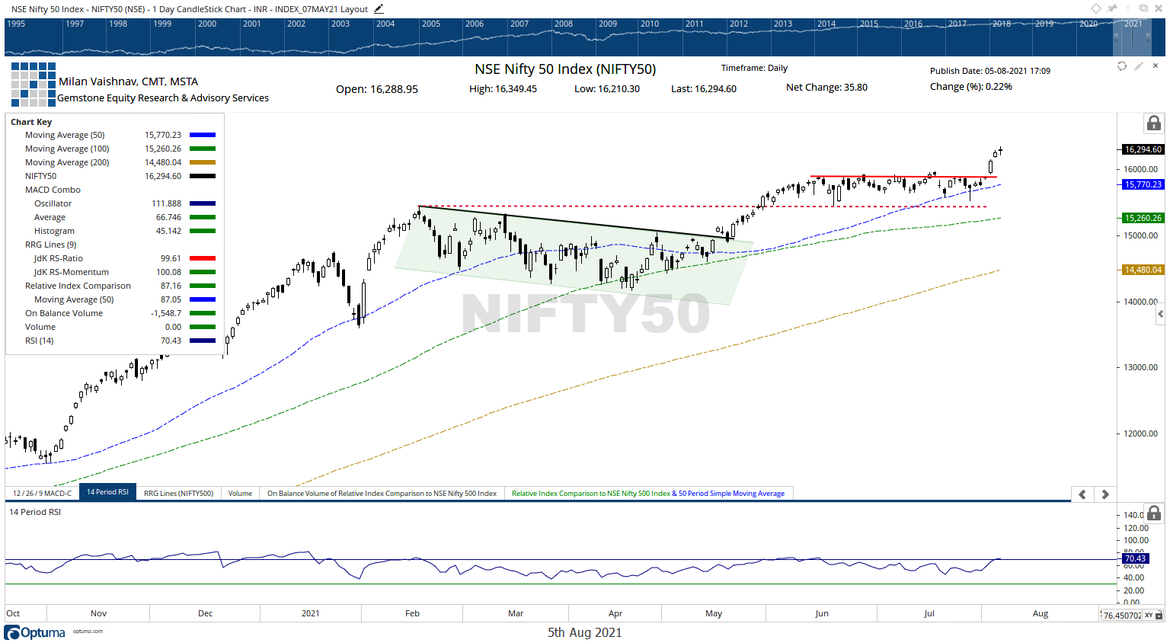

The Relative Strength Index (RSI) on the daily chart is 70.43; it has marked a new 14-period high which is bullish. The RSI is now in mildly overbought territory. However, it remains neutral and does not show any divergence against the price. The daily MACD is bullish and remains above the signal line.

The pattern analysis shows that the NIFTY has continued to extend its up move following a breakout above the 15900-15950 zone. This breakout remains very much valid and in place. In the process, the Index has dragged its support levels higher at 15900-15950 area.

All in all, the markets are again likely to consolidate near current levels within a defined range. In the event of any corrective activity, the breakout will remain very much in place so long as the NIFTY stays above 16000 levels. However, we are very much likely to see the tactical shift towards defensive large caps while the broader markets continue to underperform on a relative basis. We recommend avoiding shorts and continuing to focus on the large caps defensives while guarding profits at each incremental level.

This was first published by The Economic Times.

Milan Vaishnav, CMT, MSTA

Consulting Technical Analyst

Member: (CMT Association, USA | CSTA, Canada | STA, UK) | (Research Analyst, SEBI Reg. No. INH000003341)

Categories

RECEIVE FREE! – Weekly Market Outlook and all Special Articles when published