In what remained an antidot as compared to the previous session, the Indian equity markets consolidated within a very narrow range with near-absent volatility. It traded in a very narrow range and ended the day on a positive note. The markets saw a positive opening to the session; the NIFTY opened modestly higher and remained in a narrow 40-odd points range throughout the day. The markets did not take any directional bias and maintained its modest gains throughout the day. The headline index ended with a net gain of 69.05 points (+0.44%).

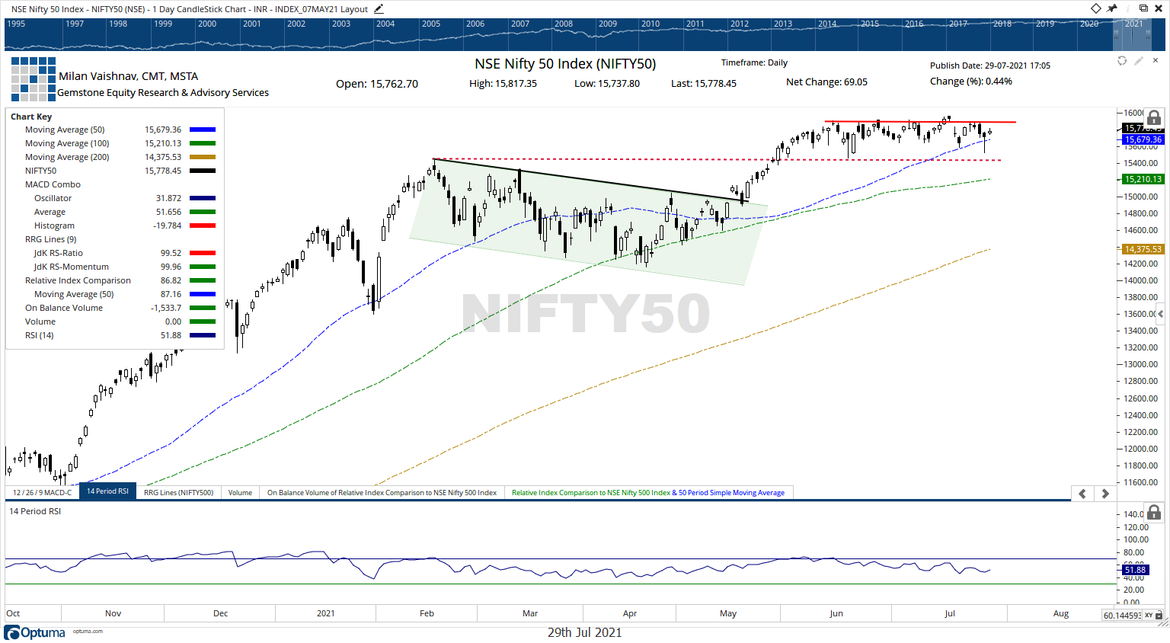

The session saw the 15800 strikes holding maximum Call OI throughout the day. The monthly derivative expiry remained quiet on expected lines. The highest Call OI at 15800 prevented the NIFTY from moving past this point. On a broader note, the markets are still very much within the broad consolidation zone that it has formed for itself with the 15900-15950 zone remaining a major intermediate resistance for the markets. The volatility declined; INDIAVIX came off by 5.45% to 12.9450. On Friday and over the coming days, the broadly defined range for the NIFTY will be 50-DMA on the lower side and 15900-15950 area on the upper side.

Friday is likely to see the levels of 15835 and 15880 acting as resistance zones. The supports come in at 15700 and 15665 levels.

The Relative Strength Index (RSI) on the daily chart is 51.88; it stays neutral and does not show any divergence against the price. The daily MACD is bearish and remains below the signal line. No significant formations were seen on the candles.

The pattern analysis shows that the NIFTY continues to remain in a rectangle formation; this formation is made from a broad consolidation zone with the levels of 15900-15950 acting as resistance. Unless this zone is taken out convincingly, any meaningful up move in the markets is unlikely.

All in all, from the intraday perspective, the zone of 15500-15550 is the lower edge of the consolidation zone for the markets. However, on a closing basis, taking support at the 50-DMA which presently stands at 15679 will be very crucial. Any slip below the 50-DMA on a closing basis will invite some weakness for the markets.

With the markets not having taken any directional bias on either side, the analysis for Friday remains on similar lines. We reiterate the need of the hour to stay highly stock-specific while approaching the markets. With vigilant protection of profits on either side, a cautious outlook is advised for the day.

This was first published by The Economic Times.

Milan Vaishnav, CMT, MSTA

Consulting Technical Analyst

Member: (CMT Association, USA | CSTA, Canada | STA, UK) | (Research Analyst, SEBI Reg. No. INH000003341)

Categories

RECEIVE FREE! – Weekly Market Outlook and all Special Articles when published