In the previous note, it was observed that the short covering from the lower levels that led to a recovery in the markets yesterday is a good sign as market participants are not comfortable staying short at lower levels. The markets traded much on the expected lines on Thursday as it managed to resume its up move after six days of consolidation. The markets saw themselves opening on a positive note. After opening with modest gains, the NIFTY only grew stronger as the day progressed. The NIFTY marked its intraday high point in the late afternoon trade. The headline index closed at a fresh high with gains of 82.15 points (+0.50%).

So long as the NIFTY is able to keep its head above the 16300 levels, there are higher chances of the index testing 16500 levels. The weekly options expiry remained less volatile; the strikes of 16200 and 16300 went on to see high Put writing and this helped the Index settling above this point. There are high possibilities of the NIFTY inching higher if the index stays above 16300. As it was evident, volatility decline and INDIAVIX came off by 2.64% to 12.3725.

Friday may see a stable start to the day. The levels of 16390 and 16500 will act as immediate resistance points. The supports are expected to come in at 16300 and 16230 levels.

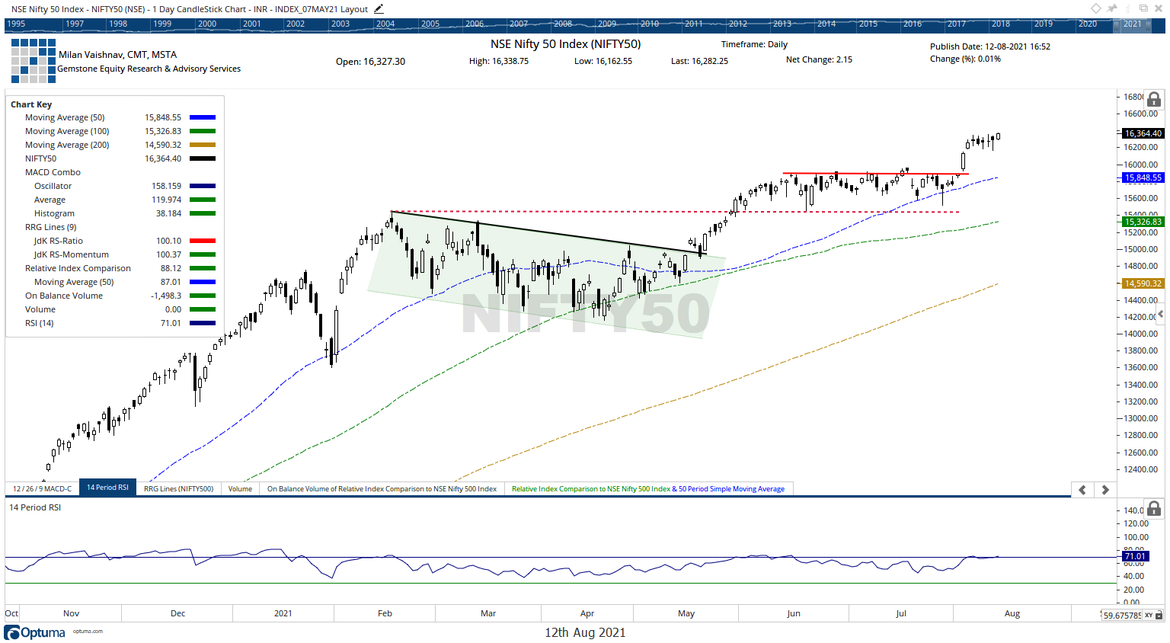

The Relative Strength Index(RSI) on the daily chart is 71.01; it shows a mild bearish divergence against the price. The RSI, however, is now in the mildly overbought zone. The daily MACD is bullish and above the signal line. A white body occurred; apart from this no other formation was noticed on the candles.

The pattern analysis shows that the NIFTY initially broke out from the 15900-15950 area and marked a new high. It then consolidated in a sideways trajectory for six sessions and has now shown intentions to resume its move on the upside.

From the technical perspective, another thing that looked like a strong supporter of the present move was the improvement in the market breadth. The up move that was seen in the previous session has come with relatively much better and stronger market breadth. The Banknifty has off late underperformed the front line NIFTY; this index is largely expected to play a catch up if the present rally sustains. Apart from this, IT stocks are also likely to perform better than the broader markets. We recommend continuing to cautiously chase the momentum while trailing stop losses to protect profits at higher levels.

This was first published by The Economic Times.

Milan Vaishnav, CMT, MSTA

Consulting Technical Analyst

Member: (CMT Association, USA | CSTA, Canada | STA, UK) | (Research Analyst, SEBI Reg. No. INH000003341)

Categories

RECEIVE FREE! – Weekly Market Outlook and all Special Articles when published