The equity markets had a session on expected lines as it saw a short covering led pullback and ended the day on a strong note. After two days of strong corrective activity, the NIFTY pulled itself back after taking support at its 50-DMA. Thursday’s session saw the markets opening on a strong note following a favorable global trade setup. After opening positive, the NIFTY got stronger as the day progressed. In the afternoon, the index did see some paring of gains but the last hour options expiry led moves pulled the markets up again. The headline index ended with a net gain of 191.95 points (+1.23%).

Some options expiry influenced moves were dominant in the markets. The 15800 strikes held the maximum Call OI for the most part of the day. This led NIFTY to resist to that point for the most part of the session. The Index move above this point only after some Call unwinding was seen at 15800. As of now, the highest Call OI stands at 16000 levels. For the immediate short term, the NIFTY behavior against 15800 will be important to watch. If the index is able to keep its head above these points, it may attempt to test the crucial 15900-15950 zone. Failure to sustain above 15800 may result in some minor corrective moves for the market.

Friday is likely to see the levels of 15865 and 15930 acting as resistance points. The supports come in at 15730 and 15680 levels.

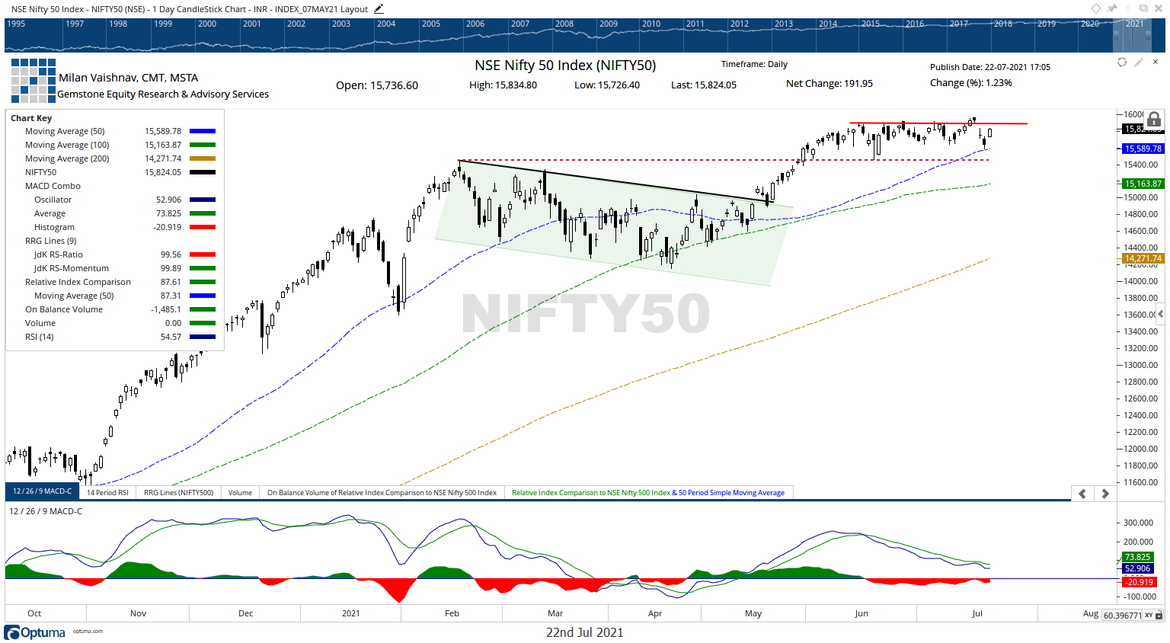

The Relative Strength Index (RSI) on the daily chart is 54.57; it stays neutral and does not show any divergence against the price. The daily MACD is bearish and remains below the signal line.

A rising window occurred on the candles. This results out of a gap up. However, at this juncture, it is important to note that the present gap is an “area gap” as it has occurred within the broad trading range of 15700-15950 levels for the NIFTY. The area gaps are not so potent and strong as breakaway and such other kinds of gaps.

The pulling back of NIFTY after taking support at its 50-DMA marks the lower edge of a broad consolidation zone. The upper edge remains at 15900-15950. So long as the NIFTY stays within this range, we will see the markets consolidating in a sideways trajectory. The 50-DMA, which is 15589 at present, remains crucial short-term support for the NIFTY for the near term.

All in all, the markets have managed to remain in the sideways trajectory of their consolidation. This trajectory has been formed over the past month. Unless the lower or the upper edge of the consolidation boundary is taken out, we continue to recommend approaching the markets on a cautious note. Aggressive positions on either side should be avoided. While keeping the exposures on modest levels, profits on both sides of the trade should be vigilantly protected.

This was first published by The Economic Times.

Milan Vaishnav, CMT, MSTA

Consulting Technical Analyst

Member: (CMT Association, USA | CSTA, Canada | STA, UK) | (Research Analyst, SEBI Reg. No. INH000003341)

Categories

RECEIVE FREE! – Weekly Market Outlook and all Special Articles when published