The Indian markets saw a strong start to the week as the headline index ended with a robust gain of 132.65 points (+1.20%). With this move, the index has once again attempted to achieve a breakout. This being said, over the past many weeks, the market breadth has been an area of concern. With each up move that we witnessed while the markets remained range-bound, it came with fractured breadth.

For any market to enjoy a sustainable secular up move, it is very important that it comes with healthy market breadth. Keeping the NIFTY aside which might see some consolidation at higher levels, we examine the CNX500 chart which suggests that we might be in for a stable market breadth over the coming days.

CNX500 is a broader market index; it is comprised of 500 stocks which represent over 95% of the floating market cap of all stocks listed on the NSE.

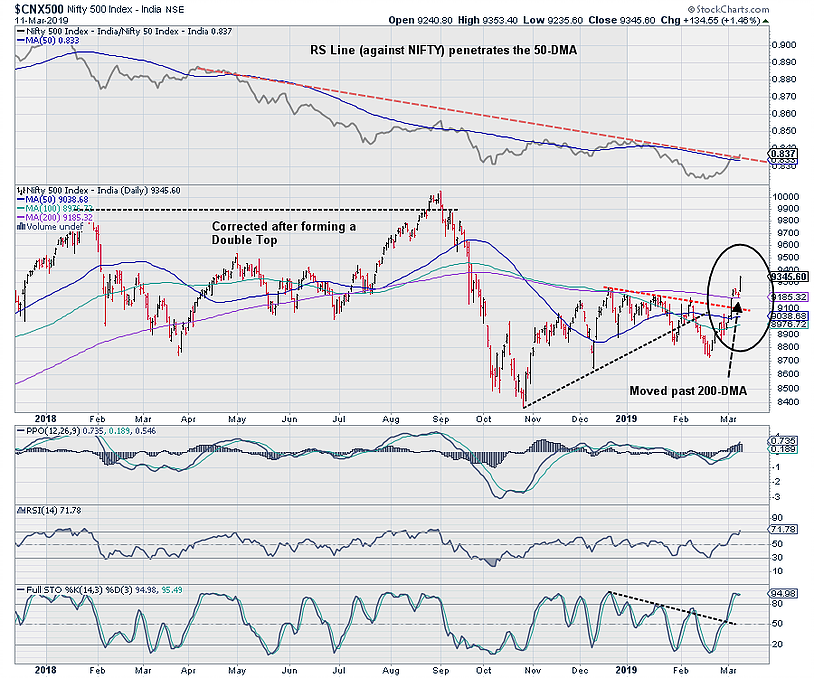

n the daily chart seen above, the RS Line appears to have reversed its downtrend and now looks to inch higher. It has penetrated its 50-DMA. The CNX500 has also penetrated the 200-DMA, consolidated briefly, and has continued to move higher.

The index looks slightly overbought on RSI and Stochastic and may cause it to consolidate. In any worst-case scenario, so long as the CNX500 holds the 9100-mark, it will help the market breadth stabilize and improve gradually.

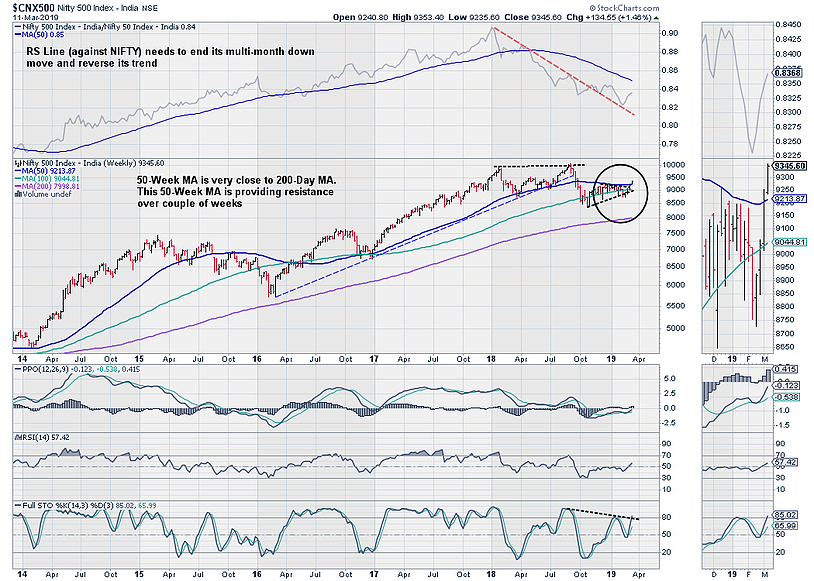

Similarly, as seen on the weekly chart above, the CNX500 index resisted to the 50-Week MA for nearly 15 weeks and has attempted a breakout. This 50-Week MA, which is presently at 9213 has almost acted as a proxy trend line. On the weekly charts, the MACD remains in continuing buy mode while PPO is positive. We should not conclusively read the weekly indicators as the week is incomplete and the final bar may change.

Overall, the 200-Day MA level of 9185 and 50-Week MA of 9213 are very important levels to watch for the coming days. This means that so long as the CNX500 index keeps its head above the 9200 levels, the market breadth will not deteriorate. Any slip below the 9200 levels will again cause cracks in the market breadth.

Milan Vaishnav, CMT, MSTA

Consulting Technical Analyst

Member: (CMT Association, USA | CSTA, Canada | STA, UK) | (Research Analyst, SEBI Reg. No. INH000003341)

Categories

RECEIVE FREE! – Weekly Market Outlook and all Special Articles when published