After declining over 35% from the 2020 peaks, the global equity markets found a temporary base, and in the current technical pullback, it has recouped over one-third of its total losses. Traders and Investors alike have formed different opinions on whether the Equities have bottomed out while they pulled back over the past couple of days. The following two charts answer this question and also provide some additional insights.

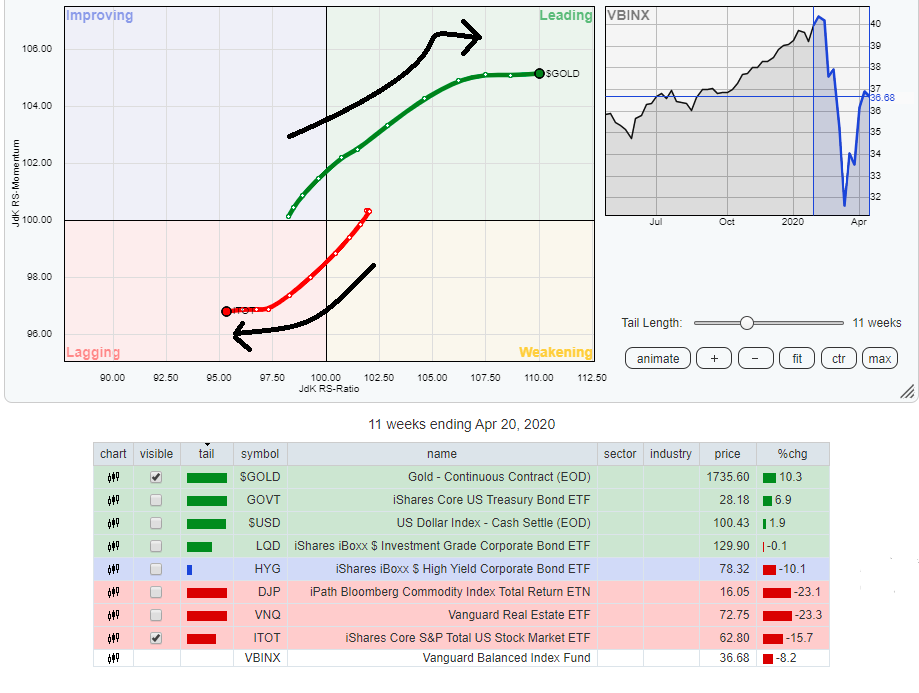

In the above Relative Rotation Graph, we compare Equities, represented by iShares Core S&P Total US Stock Market ETF (Symbol: ITOT) and Gold. We compare these two components against the Vanguard Balanced Index Fund (Symbol: VBINX). While the Gold is moving higher steadily in the leading quadrant while building on its relative momentum, the Equities are seen languishing in the weakening quadrant with no signs of any momentum picking up.

This implies that the Equities have not bottomed out despite rallying from the recent lows and recouping one-third of its total losses.

This reading is also corroborated by examination of the relationship between these two asset classes, i.e., Equities and Gold.

Milan Vaishnav, CMT, MSTA

Consulting Technical Analyst

Member: (CMT Association, USA | CSTA, Canada | STA, UK) | (Research Analyst, SEBI Reg. No. INH000003341)

Categories

RECEIVE FREE! – Weekly Market Outlook and all Special Articles when published