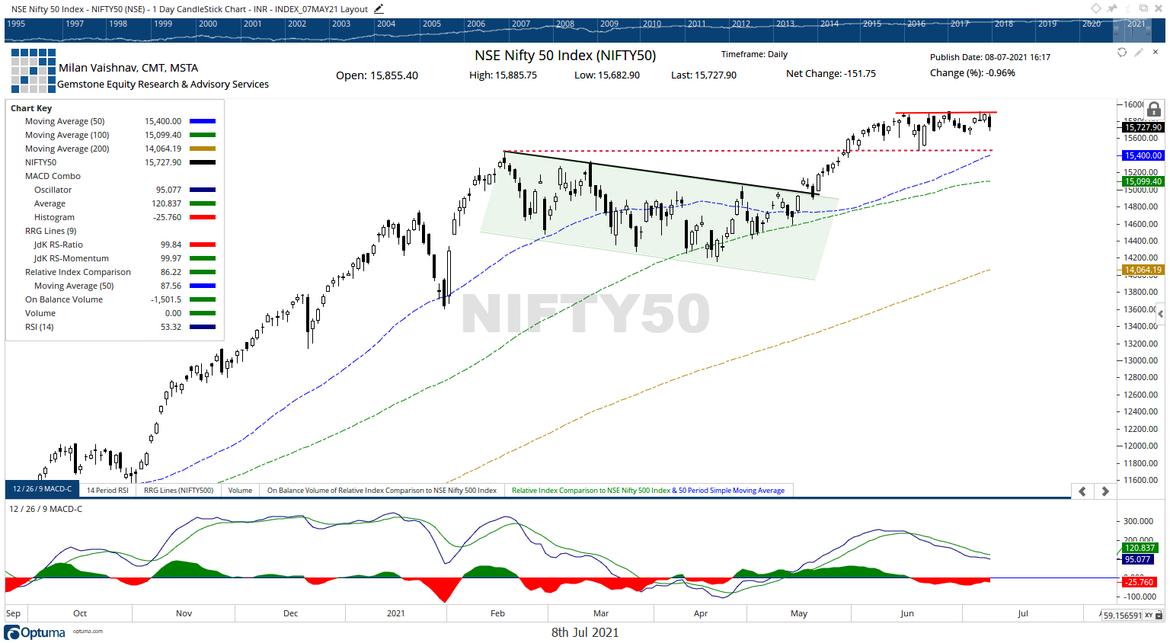

The markets finally had a corrective move as it spent the entire day in a downward trajectory to end the day with a cut. The markets opened on a resilient note and resisted weakness in the early minutes of the trade. However, selling pressure started to creep in and the NIFTY found itself in a declining channel. The Index remained in a falling trajectory throughout the day, it kept steadily losing ground and at one point in time, the NIFTY came off over 200-point from its high point. While showing no major recovery, the headline Index ended the day with a net loss of 151.75 points (-0.96%).

The expiry of the weekly options played out on the expected lines. The maximum Call OI that existed on 16000 levels shifted lower to 15800. This caused the Index to slip below this point; the highest PUT OI shifted lower to 15700. This helped the NIFTY settle above this point. Volatility spiked on the expected lines; INDIAVIX rose by 11.03% to 13.5600. Thursday’s price action marked 15900 as an intermediate top for the markets. All up move, if any, will not find serious resistance at each higher level including the 15900 point.

Friday is likely to see the levels of 15780 and 15825 acting as resistance points. The supports come in at 15680 and 15590 levels.

The Relative Strength Index (RSI) on the daily chart is 53.32; it has marked a fresh 14-period low which is bearish. RSI also shows a negative divergence; while RSI marked a new 14-period low, the price has not done so, and this resulted in the bearish divergence. RSI has made this low ahead of the price. The daily MACD is bearish and stays below the signal line.

A large black body emerged on the Candles. The occurrence of a large bearish candle exactly near the resistance point of 15900 reinforces the credibility of this level as a strong resistance area.

The market breadth remained particularly weak; 43 out of 50 stocks declined from NIFTY. Also, this phenomenon is likely to persist some time. The weak market breadth and declining internal strength will remain core technical issues that the markets will have to deal with over the coming days.

All in all, the analysis stays on similar lines as we approach the end of the week. Some minor technical pullbacks cannot be ruled out. Also, some short covering-led bounce can be expected in the high beta stocks which faced heavy selling in the previous session. We recommend staying away from such up moves if at all they occur. While staying put with purchases in defensive stocks, we recommend adopting a highly cautious outlook on the markets.

This was first published by The Economic Times.

Milan Vaishnav, CMT, MSTA

Consulting Technical Analyst

Member: (CMT Association, USA | CSTA, Canada | STA, UK) | (Research Analyst, SEBI Reg. No. INH000003341)

Categories

RECEIVE FREE! – Weekly Market Outlook and all Special Articles when published