The markets continued to consolidate and came off from their high point to end the day on an absolutely flat note. The NIFTY took no directional bias, showed no inclination on moving higher, and corrected through the course of the day. Markets saw a stronger-than-expected start to the day. The Index opened higher and sustained most of its gains through the first half of the day. The afternoon session saw a violent shakeout; NIFTY came off over 100-points from the high point of the day. Following a range-bound trade and some recovery, the headline index ended flat with a negligible gain of 2.80 points (+0.02%).

The technical picture remains evidently weak. The strikes of 15700 and 15800 saw significant call writing during the day. The level of 15800 continues to hold maximum Call OI; this has seen the resistance levels shifting lower from 16000 to the 15800 levels. Some modest Put unwinding was also seen at 15700 indicating a fragile approach of the market participants vis-à-vis taking a buoyant view on the markets. The volatility remained unchanged; INDIAVIX rose marginally by 0.38% to 12.9925.

Tuesday may see a tepid start to the day. The short-term resistance points have shifted lower. The Index may find resistance at 15750 and 15830 levels. Supports may come in at 15600 and 15535 levels.

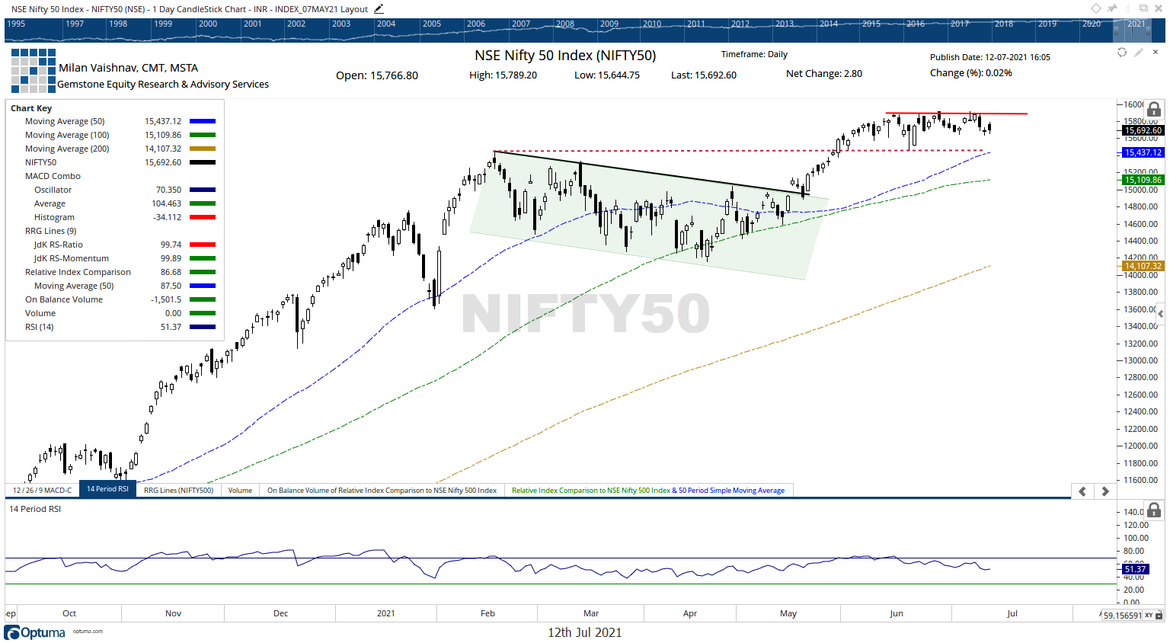

The Relative Strength Index (RSI) on the daily chart is 51.37; it stays neutral and does not show any divergence against the price. The daily MACD is bearish and remains below the signal line. A black body occurred; apart from this no other significant formations were seen on the charts.

The pattern analysis shows that the NIFTY has formed a strong resistance area in the 15850-15900 zone; the level of 15900 has become an intermediate top for the markets unless it is taken out convincingly. The markets have been consolidating in a very narrow band with a downward bias.

All in all, if we examine a short-term technical setup, the picture looks weak. The options data suggests that the call writing done at levels below the 16000-mark has bought short-term resistance point lower at 15800. The markets will continue to see profit taking bouts at higher levels unless the upper resistance zone of 15850-15900 is taken out forcefully and in a convincing manner. We recommend continuing to stay highly stock specific. While keeping exposures at modest levels, it is suggested to keep using all up moves, if at all they occur, to protect profits at higher levels.

This was first published by The Economic Times.

Milan Vaishnav, CMT, MSTA

Consulting Technical Analyst

Member: (CMT Association, USA | CSTA, Canada | STA, UK) | (Research Analyst, SEBI Reg. No. INH000003341)

Categories

RECEIVE FREE! – Weekly Market Outlook and all Special Articles when published