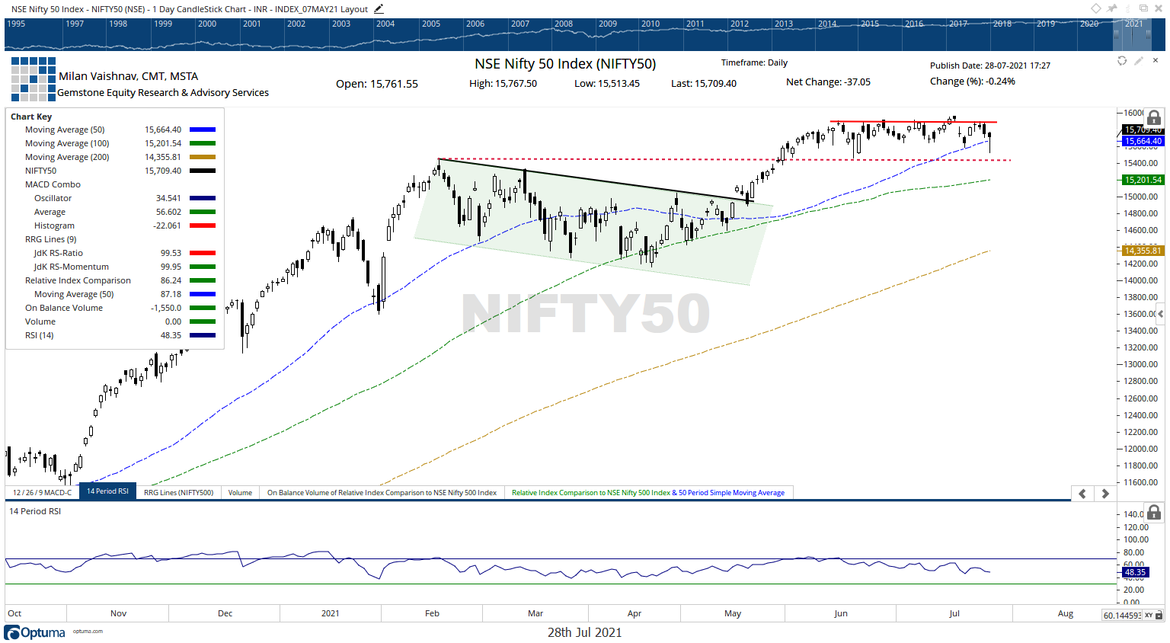

The equity markets continued to remain under corrective pressure and ended yet another day on a negative note. The markets saw a much weaker than expected opening and soon was gripped by a strong corrective move. The NIFTY slipped sharply and went below crucial intraday supports; it went very near to the 15500 levels. However, the remainder of the session saw an equally remarkable turnaround; NIFTY saw itself recovering nearly 200-odd points from the intraday low levels. The headline index finally ended the day with a modest loss of 37.05 points (-0.24%).

We have both weekly options expiry and the monthly derivatives expiry lined up in the next session. The levels of 15800 and 15900 levels have seen heavy call writing; this may keep all expected pullbacks limited and defined. On the lower side, the highest Put OI stands at 15600-15700 levels this keeps the lower side limited as well. Broadly, we can expect a session with a defined range on the expiry day. The behavior of the NIFTY against the price level of 15700 will be crucial. The volatility also continued to inch higher; INDIAVIX rose by 3.48% to 13.6925.

Thursday can see the levels of 15780 and 15845 are likely to act as resistance points. The supports come in at 15650 and 15580 levels.

The Relative Strength Index (RSI) is at 48.35; it stays neutral and does not show any divergence against the price. The daily MACD is bearish and remains below the signal line.

A classical hammer occurred on the candles. This shows the discomfort of market participants at lower levels; the occurrence of the hammer between 15500-15550 area marks this zone as its important support area for the near term.

All in all, the NIFTY has now ended up defining a broad sideways consolidation range for itself. With the 15900-1950 zone acting as an upper resistance zone, the support area now exists between the 15500-15600 zone. The 50-DMA, which presently stands at 15664 is expected to act as an important near-term support point for the NIFTY on a closing basis.

We recommend continuing to approach the markets on a selective note. A cautious approach is required while scouting for stocks that have better and improving relative strength against the broader markets. A continued cautious view is advised for the day.

This was first published by The Economic Times.

Milan Vaishnav, CMT, MSTA

Consulting Technical Analyst

Member: (CMT Association, USA | CSTA, Canada | STA, UK) | (Research Analyst, SEBI Reg. No. INH000003341)

Categories

RECEIVE FREE! – Weekly Market Outlook and all Special Articles when published