Markets witnessed yet another surge of up move; moved past the expected resistance levels of 17200 as it ended above that. NIFTY saw a quiet start to the day; it stayed throughout the day in the positive territory. While forming low at its opening levels, the Index never slipped inside the negative zone. The markets saw a steady linear up move for the entire session and showed no signs of volatility. The headline index ended on a strong note posting gains of 157.90 points (+0.92%).

The weekly options expiry happened without much volatility. In fact, the INDIAVIX rose just 0.39% to 14.2400. The NIFTY also went past the 17200 levels; this was the point that had accumulated maximum Call OI throughout the week. This depicts the inherent strength of the markets. With just one day of a mild corrective move, the markets have piled up strong gains over the past few days. Despite the strength that is evident, it is now time that some consolidation at higher levels is imminent and cannot be ruled out. Any quantum of ranged consolidation that may happen now, will, in fact, be healthy for the current bull run.

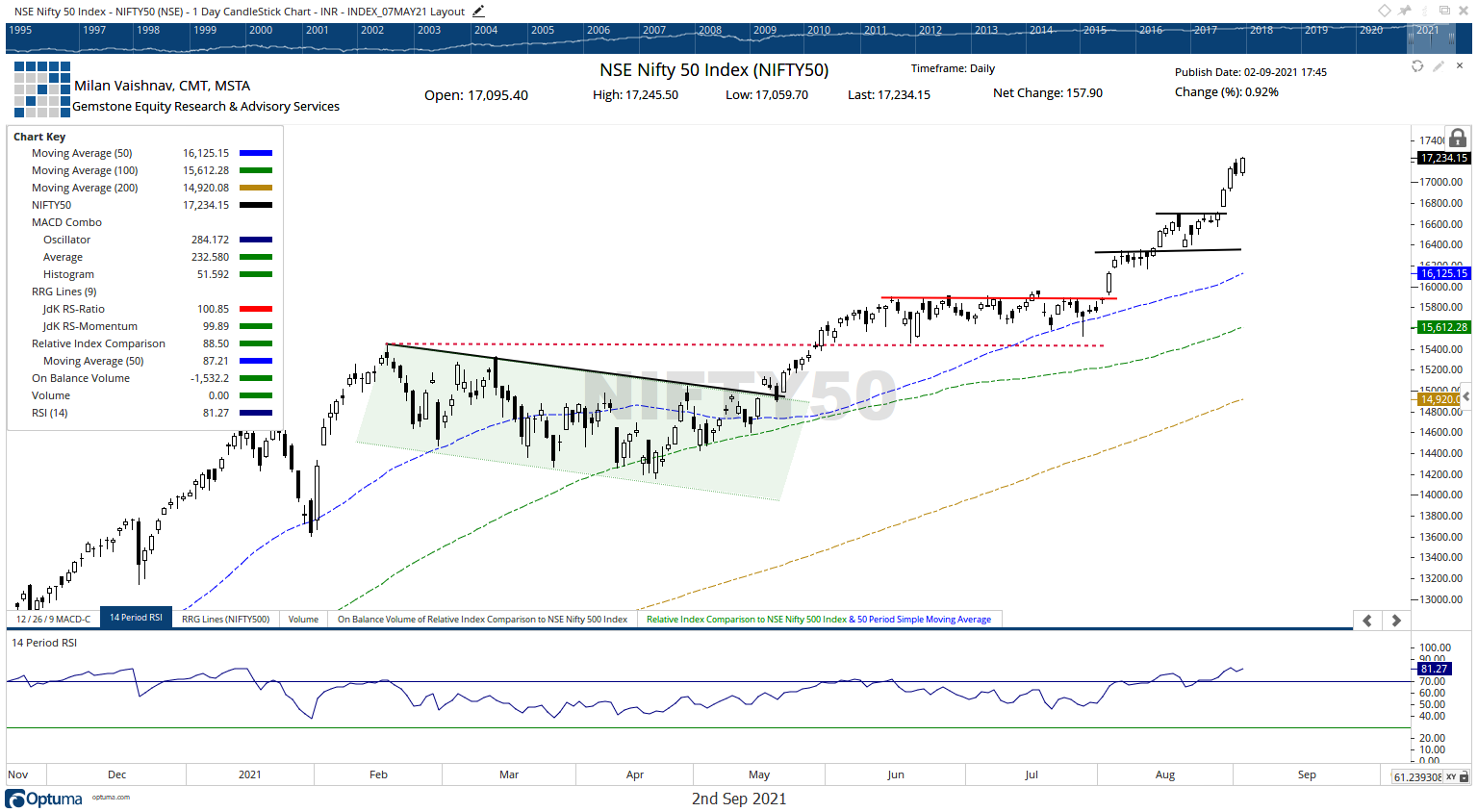

Friday is likely to see the levels of 17265 and 17330 acting as resistance points. The supports come in at 17145 and 17070 levels.

The Relative Strength Index (RSI) on the daily chart is 81.27; it remains in the overbought territory. RSI also shows some mild bearish divergence against the price. The daily MACD is bullish and it trades above its signal line.

A strong white body emerged on the candles. This reflects the directional consensus of the market participants throughout the session.

Overall, the markets are giving enough signals that point towards the NIFTY inching higher. However, given the quantum of the up move that has happened over the past couple of days, any ranged consolidation should never come as a surprise to anyone. In fact, this is the time to get extremely vigilant and continue strictly trailing the SL levels to protect profits. While continuing to stay stock-specific in the approach, a cautiously positive approach is advised for the day.

This was first published by The Economic Times.

Milan Vaishnav, CMT, MSTA

Consulting Technical Analyst

Member: (CMT Association, USA | CSTA, Canada | STA, UK) | (Research Analyst, SEBI Reg. No. INH000003341)

Categories

RECEIVE FREE! – Weekly Market Outlook and all Special Articles when published