After a strong move of over 400-points of upside, the markets did consolidate on the expected lines. However, it did not while showing a lot of internal strength. The NIFTY opened on a modestly positive note; it got stronger in the first hour of the trade. Just when it looked that the markets are continuing with their unabated up move, some profit-taking kicked in on the anticipated lines. The NIFTY came off over 175-points from the intraday high point. While not displaying any extraordinary weakness; the headline index ended the day with a net loss of 55.95 points (-0.33%).

Thursday brings us to the weekly options expiry; the options data is showing a mixed picture. On one hand, a very high Call OI open addition was seen at 17000 levels while 17100 holds the highest Call OI as of now. On the other hand, the strike of 17000 not only saw the highest addition of PUT OI, but it also holds maximum PUT Open Interest as well. This means that unless there is a tactical change on either side, the markets may well stay capped in a limited range. Volatility declined as evident from INDIAVIX which came off by 2.30% to 14.1850.

A steady but soft start is expected on Thursday. The levels of 17100 and 17145 may act as immediate resistance points. The supports will come in at 17010 and 16970 levels.

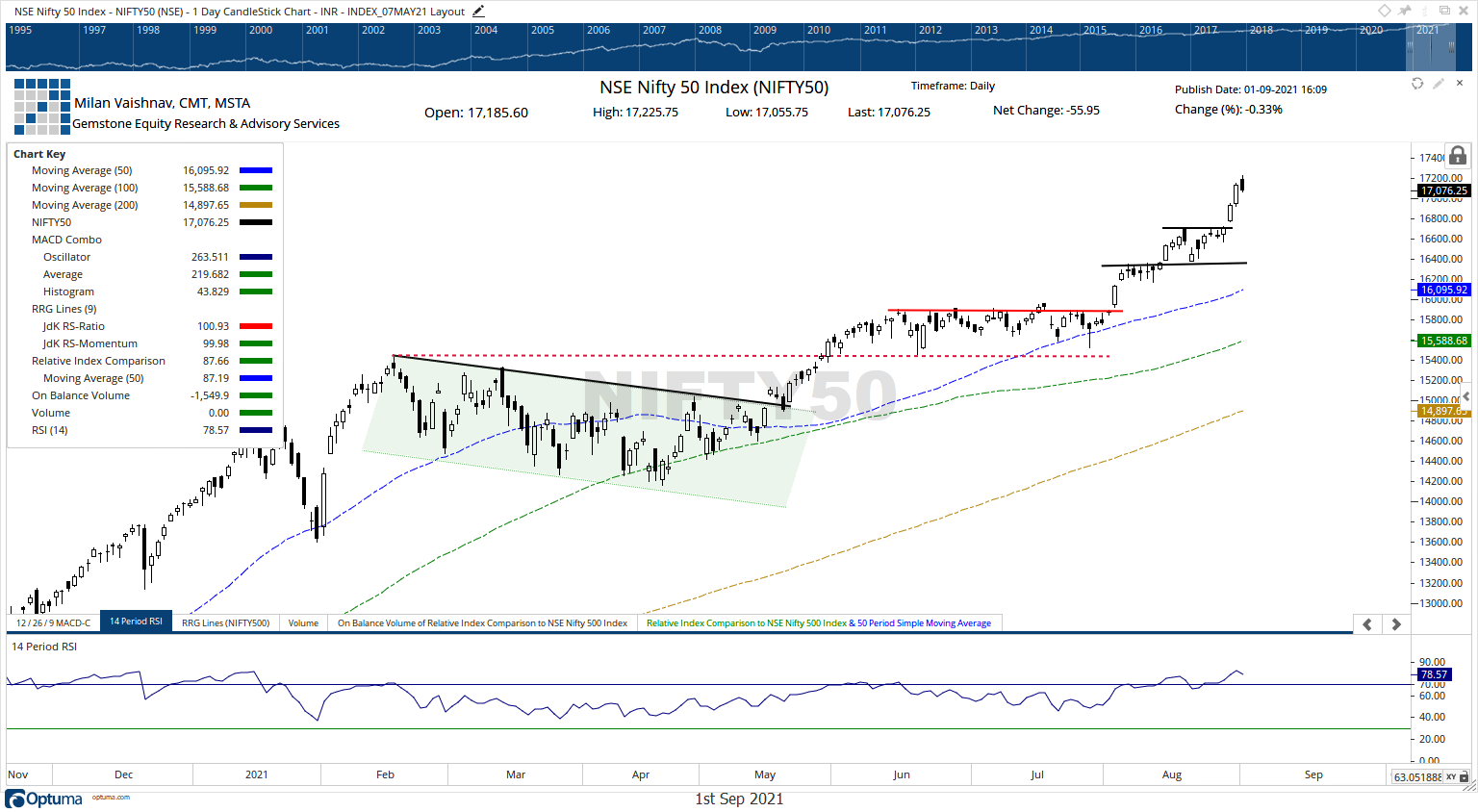

The Relative Strength Index (RSI) on the daily chart is 78.57. RSI stays in the overbought territory; however, it also remains neutral and does not show any divergence against the price. The daily MACD Is bullish and continues to trade above the signal line.

A black body occurred on the candle. This was a result of the markets closing below their opening levels. Apart from this, no other important formation was noticed.

The banking stocks put up resilient performance; along with that, the Realty stocks also performed strongly. This is a classical case of the sectors that have relatively underperformed the NIFTY in the recent past and are now trying to play catchup. This fabric of the market is likely to persist for some more time. We expect the banks, realty, and pharma stocks to continue to show improved relative performance over the coming days.

Since the possibility of a range-bound consolidation is not ruled out now, we recommend continuing to stay high defensive while approaching the markets. Though shorts may be avoided as the undercurrents remain strong, all profits on the long side should be vigilantly protected.

This was first published by The Economic Times.

Milan Vaishnav, CMT, MSTA

Consulting Technical Analyst

Member: (CMT Association, USA | CSTA, Canada | STA, UK) | (Research Analyst, SEBI Reg. No. INH000003341)

Categories

RECEIVE FREE! – Weekly Market Outlook and all Special Articles when published