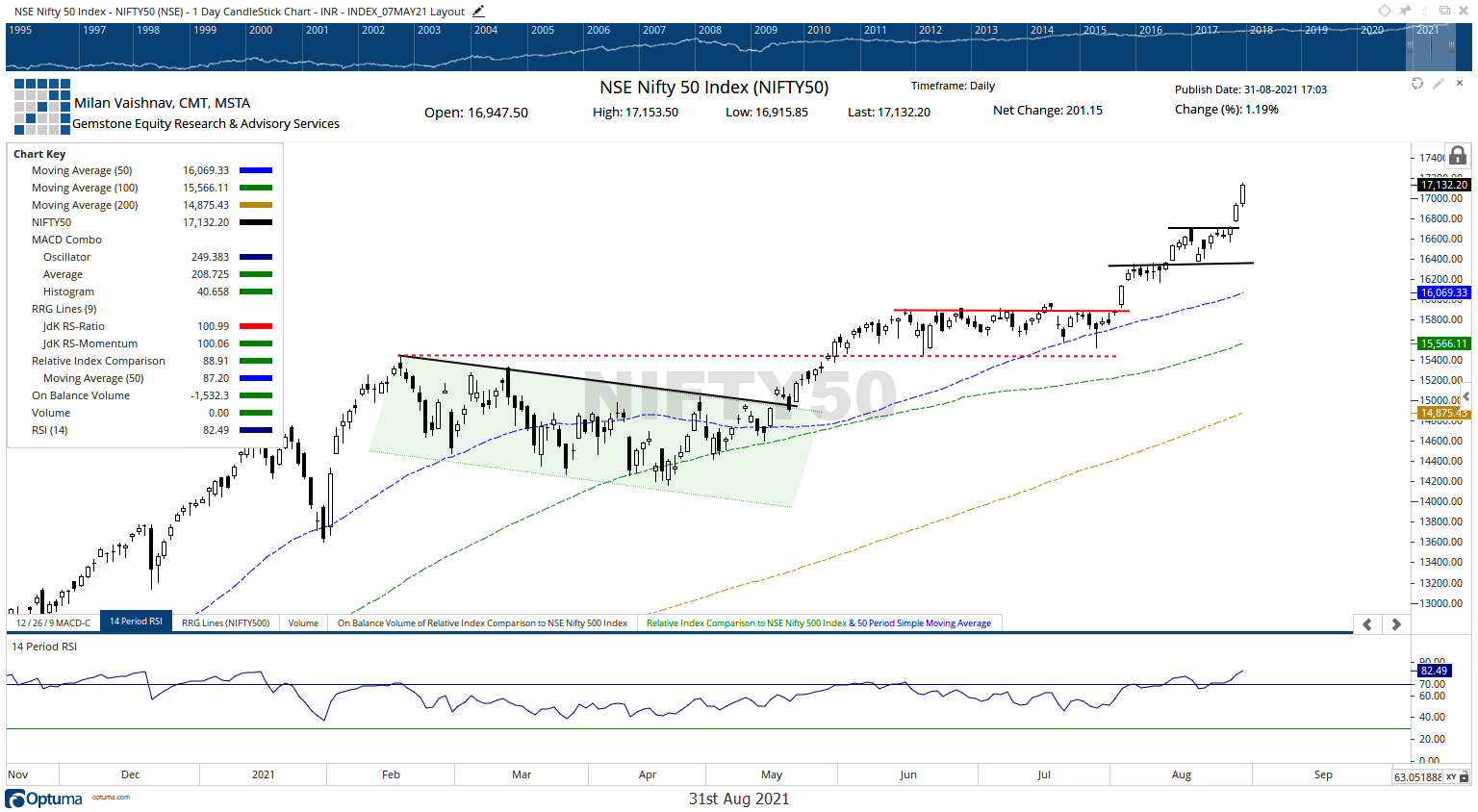

While showing robust strength, the markets added more gains today for the second day in a row to end at a new lifetime high again. It was the second day, when the NIFTY registered gains in excess of 200 points. The global markets were subdued in the morning, and the NIFTY too stayed resilient but subdued in the first hour of the trade. However, it grew stronger as the day progressed and the index navigated the 17k levels and moved higher. The markets saw some mid-day momentary sharp profit taking; however, the losses were limited and it recovered again to scale new highs. The headline index finally ended with a strong gain of 201.15 points (+1.19%).

NIFTY now stays distinctly overbought; stays very much prone to some consolidation at current levels. However, the way it witnessed very short-lived profit-taking and then recovered is a clear sign of more unending strength in the markets. However, we need to keep this in mind and avoid any major shorts. However, while chasing the up move, regardless of its strong behavior, it is time that one must stay extra-vigilant and protect profits at higher levels.

In an unusual behavior, the volatility also spiked; INDIAVIX shot up by 9.02% to 14.5200. The levels of 17150 and 17200 are likely to act as resistance; the supports are likely to pitch in at 17000 and 16950. Any corrective move or consolidation is now expected to make the trading range wider.

The Relative Strength Index (RSI) on the daily chart is 82.49; it has marked a new 14-period high and it is bullish. RSI stays strongly overbought but also remains neutral and does not show any divergence against the price. The daily MACD is bullish and above its signal line. A strong white body occurred; this reflects the strong upside directional consensus of the market participants.

Apart from just one short-lived intraday correction that was seen, the options data also show a lot of underlying strength in the markets. There was a lot of PUT unwinding that happened between 16700 and 16800 levels. On the other hand, 17000 saw large addition of Call OI taking place. This all shows that in the event of any down move, the same may remain very limited in the extent.

However, that being said, given the kind of up move that we have seen, it would be prudent to now tread the markets cautiously. Most of the “safe” up moves are likely to happen in underperforming stocks like banks and Auto. Where there is a strong run-up, it would be prudent to keep vigilantly protecting profits at higher levels. While staying highly alert, a stock-specific approach is advised for the day.

This was first published by The Economic Times.

Milan Vaishnav, CMT, MSTA

Consulting Technical Analyst

Member: (CMT Association, USA | CSTA, Canada | STA, UK) | (Research Analyst, SEBI Reg. No. INH000003341)

Categories

RECEIVE FREE! – Weekly Market Outlook and all Special Articles when published