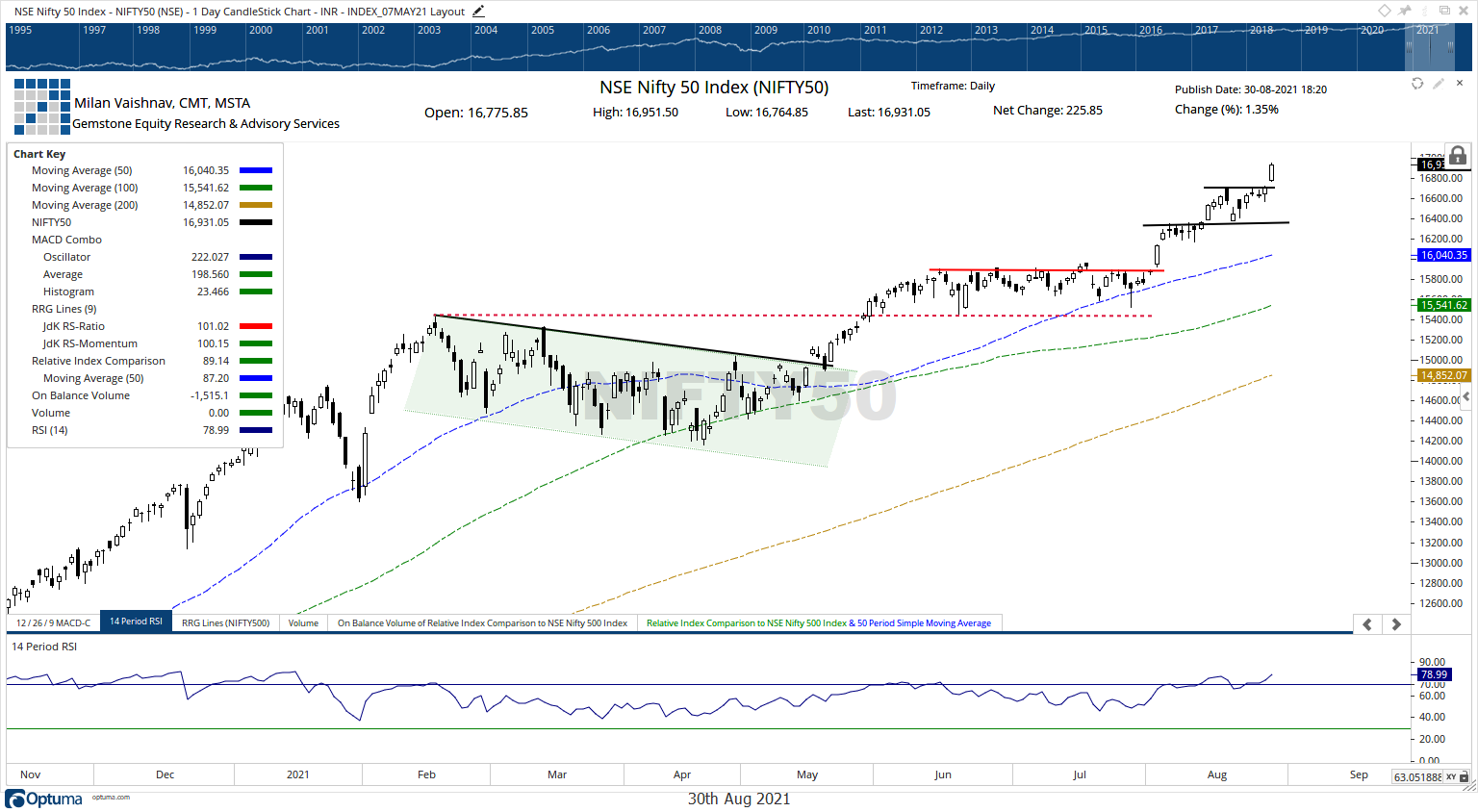

While moving precisely on the expected lines, the Indian equity markets staged a strong breakout as it went near to the 17000-mark while ending once again at a new lifetime high. The markets opened on a positive note. This saw the NIFTY opening higher; it only got stronger as the day progressed. The index saw a steady rise throughout the day as it kept making incremental highs. The markets saw no signs or any intentions to correct or retrace at any level. It managed to end near the high point of the day while posting robust gains of 225.85 points (+1.35%).

The markets have staged a strong breakout, in the process, it has dragged its support levels higher at 16650-16700 area. The surge in the markets was secular as it was spread across all sectors. The Banknifty, which was a laggard until now, also ended up strong as it started to play catch up on the expected lines. The volatility stayed nearly unchanged with INDIAVIX losing just 0.65%. In the event of any consolidation, the zones of 16650-16700 will now act as immediate short-term supports for the markets. The present technical setup suggests that there are increased possibilities of the NIFTY testing the 17k mark.

Tuesday may once again see a positive start; the levels of 16690 and 17045 may act as immediate likely resistance points. The supports come in at 16865 and 16810.

The Relative Strength Index (RSI) on the daily chart is 78.99; it has marked a new 14-period high which is bullish. The RSI is now strongly overbought which shows the inherent strength of the markets; it stays neutral and does not show any divergence against the price. The daily MACD is bullish and stays above the signal line.

A rising window emerged on the candles. This is the result of a gap and with the NIFTY closing near its high point. Such formations have buoyant implications and usually resolve with the continuation of the current up move.

All in all, the present technical setup suggests that there is still some room for the NIFTY on the upside. The Index may test the 17k levels; and then may see some profit-taking or consolidation happening in a range-bound manner. If the markets go in some consolidation, we will see sector-specific outperformance to continue. We recommend continuing to chase the momentum and keep a close eye on the Pharma, Banks, and the Consumption stocks as these groups may continue to show relative outperformance over the immediate near term. A positive outlook is advised for the day.

This was first published by The Economic Times.

Milan Vaishnav, CMT, MSTA

Consulting Technical Analyst

Member: (CMT Association, USA | CSTA, Canada | STA, UK) | (Research Analyst, SEBI Reg. No. INH000003341)

Categories

RECEIVE FREE! – Weekly Market Outlook and all Special Articles when published